Data from Experian’s latest 2021 Global Decisioning Report reveals two opposing economic trends highlighting the trend of some consumers thriving while others struggle with finances.

As the credit risk environment continues to evolve amidst the pandemic, the spotlight is on credit risk management and the need for lenders to have a comprehensive understanding of the risk and opportunity of their portfolio, as well as visibility into changes to customer profiles.

The shift in the lending and credit landscape

The present lending and credit landscape are complicated by a dual economy. Individuals on one end of the spectrum have more cash than they started out with at the beginning of the pandemic and are now ready to spend. Additionally, there are those who continue to struggle financially and have not recovered from the effects of the pandemic.

Forty-six per cent of APAC consumers surveyed say they have cut back spending, compared to 21% of higher-income households that increased spending.

Thirsty-two per cent of APAC consumers say their household income has declined since COVID-19, while 23% of those from the highest-earning brackets report discretionary income increases since the start of the pandemic due to having fewer areas to spend such as dining out or going on holidays.

A sharp rise in loan applications

Since the start of the COVID-19 pandemic, banks and financial institutions across the APAC region have seen a 74% increase in loan applications.

This increase in conjunction with the changing credit landscape has led to 63% of APAC businesses expressing concern about their customers' creditworthiness, with broader economic uncertainties impacting customer behaviour.

Banks surveyed in the report anticipate that when government stimulus packages and loan holidays end, there will be increased consumer demand for paying credit card bills and small business loans, with banks foreseeing 20% of demand for credit card bills and small business loans respectively in coming months.

To address these concerns, businesses have begun to invest in resources to enhance analytics and machine learning solutions to analyse and test new credit risk and forecasting models. 70% of APAC businesses surveyed reported already having a plan in place to manage defaulting customers.

The future of credit risk management

There is a shift in digital expectations, with only a third of APAC consumers surveyed willing to wait up to 30 seconds before abandoning an online transaction. It is clear that modern-day customers expect to be able to apply for credit when and where they need it.

To maintain a competitive edge, businesses need to transform their operations for digital decisioning in order to reach customers in real-time with the most relevant and contextual offers.

Experian’s data shows that 91% of businesses had a strategy in place pertaining to their digital channels and customer journey and 54% say that they have implemented this since the start of the pandemic.

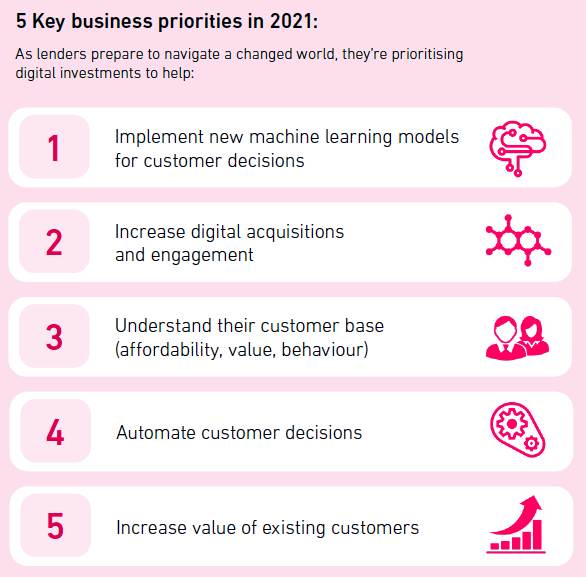

Businesses and lenders in the region are increasingly prioritising initiatives focused on better understanding their customers and enhancing mobile or digital channels. This demonstrates how expanded data sources, technology and self-service lending will be the future of credit risk management.

Action item for lenders

- Leverage data and advanced analytics – this will ensure lenders have a comprehensive understanding of the risk and opportunity of their portfolio as well as visibility into changes to customer profiles.

- Proactively engage customers – offer new credit and other products to support those that have recovered and are ready to engage.

- Prepare for a potential wave of delinquency – as payment holidays come to an end, lenders should make it easy for customers that are still struggling and offer online support and flexible terms to help solve their problems.

Ben Elliott, CEO Asia Pacific, Experian, says the credit environment is changing quickly, causing consumers and businesses to experience the financial impact of the pandemic on opposite ends of the spectrum.

“To cater to this duality, banks and financial institutions are adjusting their priorities, with at least a fifth of them increasing digital acquisition and digital engagement, automating and managing customer decisions, and making efforts to better understand their customer base,” he continued.

He opined that a digital-first approach to the consumer experience and credit risk management process is crucial.

Further, prioritising technology-driven solutions – in particular, data and analytics – will be key for businesses and lenders to respond effectively to this dual economy and remain relevant in the face of new challenges.