Authentication-based SMS revenue will reach US$39 billion globally in 2022, representing 5% of total operator-billed revenue. Juniper Research says this revenue is under threat from flash calling.

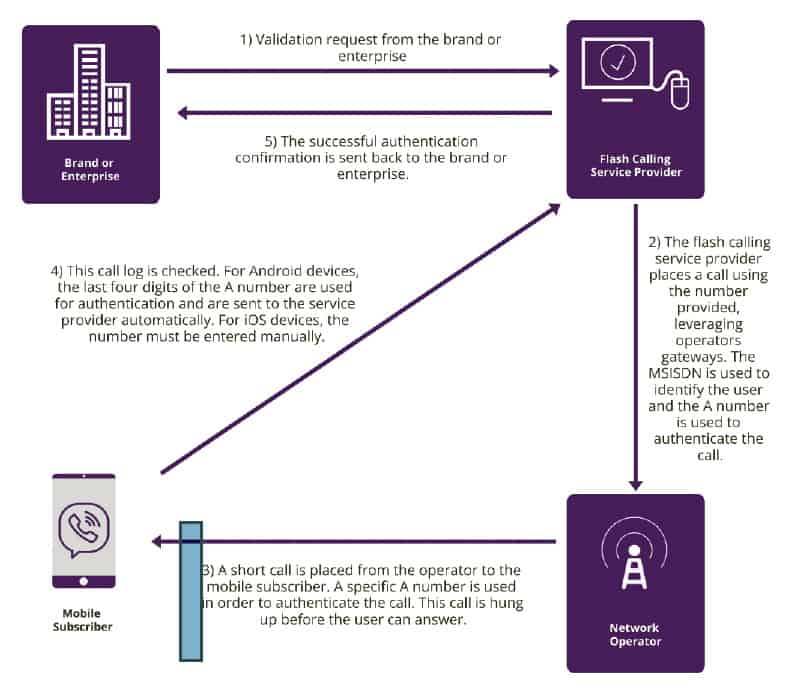

Like SMS and other voice verification services, flash calling leverages the Mobile Station Integrated Services Digital Network or MSISDN, sometimes referred to as the A number. MSISDN services often require a degree of user interaction, such as inputting the password or passcode into another platform.

Figure 1: The Flash Calling Authentication Process

The difference is that flash calling is a much more passive user process. The A number from the flash calling service provider is used as the authentication code, which can be done automatically over most smartphones.

The last few digits of this phone number are then automatically used for authentication, rather than a user inputting a code manually that was delivered by SMS. The call is connected and immediately disconnected.

The move to flash calling is being driven by the low cost of termination, a convenient user experience, and a diminished threat of fraud.

Possible bad news

In a new study, Flash Calling Authentication: Impact Analysis & Market Forecasts 2021-2026, the researcher predicts that flash calling has the potential to threaten a significant part of operators’ SMS business messaging revenue.

The report found that the number of calls used for flash authentication will be near 130 billion globally by 2026, up from less than 60 million in 2021. This represents growth of over 185,000% in the next five years.

Good news for now

However, many operators are still unable to identify flash calling traffic and cannot fully monetise it.

Juniper Research recommends that operators quickly implement solutions that can identify this traffic.

For more insights, download our free whitepaper: Flash Calling’s Impact on Business Messaging

Operators’ SMS business messaging under threat

As enterprises migrate their authentication traffic to voice, operators must protect SMS revenue by adopting voice firewalls that can detect unmonetised flash calling and attain flash calling revenue.

“Flash calling services have the potential to disrupt SMS technology to an unprecedented degree. Operators need to support services over both SMS and flash calling, and a failure to do so will lead to reduced revenue from authentication,” said Sam Barker, head of analytics and forecasting and author of the report.

In terms of market adoption, OTT applications such as Imo have already announced their intentions to launch flash calling services. The report anticipates that flash calling will provide OTT applications with a significant platform to migrate SMS business messaging traffic to their services over operator-based services.