Most financial services leaders are heavily invested in learning more about what customers care about most. Often overlooked, however, are the things customers DON’T care about. A closer look at the other side of the coin can help with project and investment prioritization, cultural changes, and improved customer experience. And I’ll bet they surprise you…

Here are four things customer DON’T care about:

Switching Channels

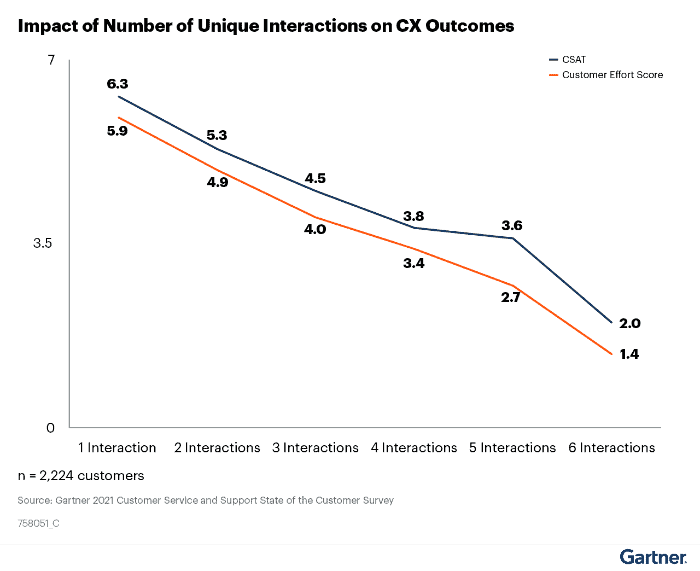

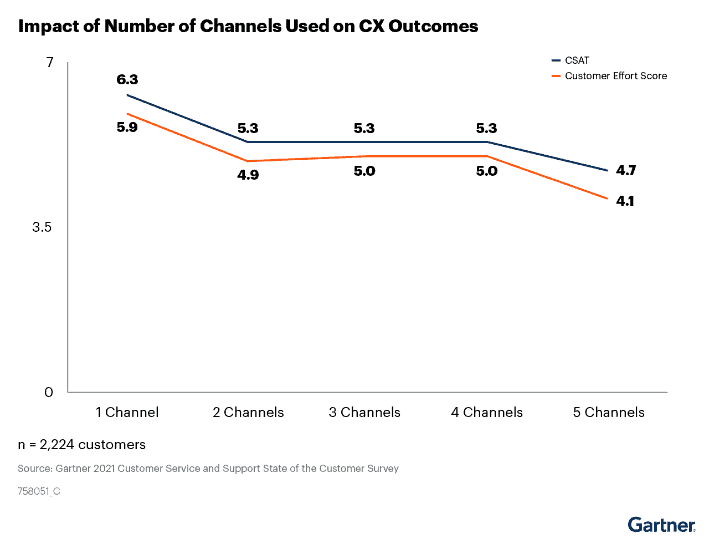

The data here can be confusing and misleading. Switching channels can be a real pain point that results in increases in customer effort and decreases in customer satisfaction. This is especially true of the first time a change in channels is required.

But customers don’t mind switching channels so much if their issue is resolved in one, continuous interaction. With each additional service interaction, not channel, customers become increasingly frustrated and dissatisfied.

In fact, there is no statistically significant difference in customer satisfaction (CSAT) or customer effort score (CES) between customers who switch between two, three or four service channels during a single interaction. Customer experience metrics such as CSAT and CES decrease by about 20% with every additional interaction.

To remedy this, rather than leaving it to the customer to guess which path is best for their issue, leading service organizations orchestrate customer journeys. They do so by deliberately guiding customers to the best-fit channel for their issue.

When channel switching is necessary, leaders must ensure that the customers’ journey context is also transferred, accelerating resolution time and reducing the likelihood of the customer requiring a separate interaction.

Positive Emotions

While pursuing greater customer-centricity, leaders often aim to “delight the customer.” This is a wonderful goal that can drive customer-centricity, but a more impactful approach would be to “not infuriate the customer.”

Positive emotions like “delight” and “amazement” have a nominal impact on client actions, while negative emotions like “frustration” and “concern” show an outsized impact.

Take our previous point about channel switching as an example; boosting positive emotions decreases self-service channel containment by 0.4%, while reducing negative emotions increases containment by 24.8%.

Get ahead of negative emotions by focusing on the three C’s:

- Clarity – Advice should be simple and directional.

- Credibility – Content should be relatable and believable.

- Confirmation – Provide messaging to signal that actions are being taken or are complete.

Sympathy

Companies frequently overuse sympathy (as opposed to empathy) in marketing and selling strategies. This aggravates customers and risks promoting increased churn through a lack of empathetic understanding of the customer’s current situation. Good intentions don’t always mean good outcomes. And overzealous sales strategies can cause customers to lose trust in their provider.

Leaders should avoid sympathy, and augment current segmentation and persona work by understanding how different states of mind drive buyers to engage (or not engage). Avoid telling customers about products and services first. Apply empathy to allow buyers to see themselves in their current state of mind and in their current buying problems.

Satisfaction

Most service organizations attempt to increase customer loyalty by improving customer satisfaction with the service interaction itself. However, customers ultimately display loyalty to the value they receive from a company’s product, not the service experience itself.

In fact, if customers receive value enhancement during a service interaction, they have an 82% probability of staying with that organization when presented the opportunity to switch, an 86% probability of increasing their wallet share and a 97% probability of spreading positive word of mouth… Truly staggering numbers!

Financial services leaders must refine their CX strategies by shifting focus away from marginal improvements to customer satisfaction with service interactions and more towards ensuring customers receive value from products and services.

These issues can be both surprising and confusing, and understanding what customers DON’T care about is an often-overlooked lever for improving customer experience, informing project prioritization, and driving culture change.

This article was first published on Gartner Blog Network