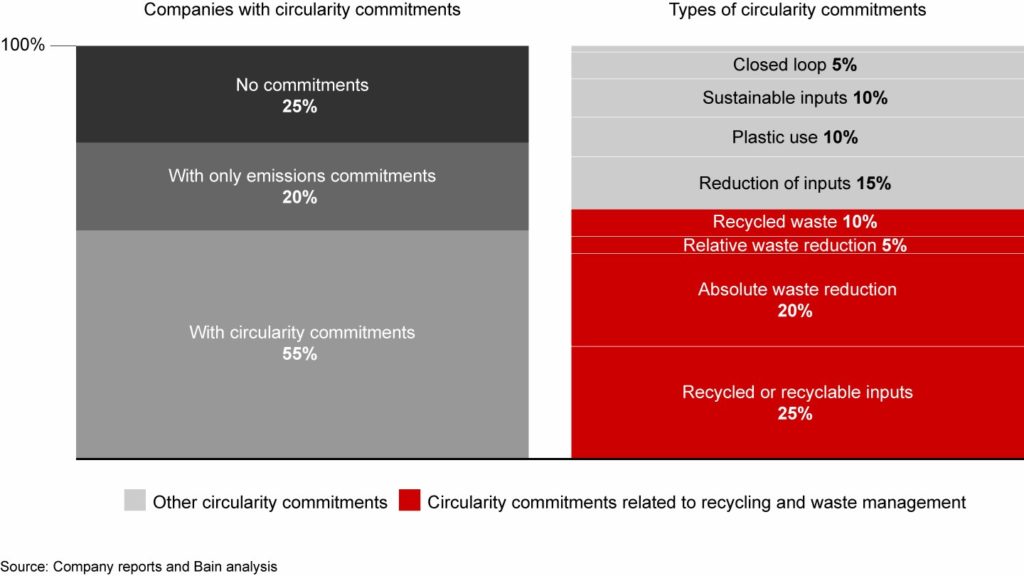

A Bain & Company study, Strategy in a Circular World, reveals that 55% of large businesses have made commitments to circularity, but a linear mindset is preventing them from truly embedding it into their businesses.

The research shows more than half of the circular initiatives businesses pursue are narrowly confined to recycling or waste management strategies, rather than embracing the full suite of technologies and business models needed for a circular economy, including re-engineering products to last longer, embracing repairability, adopting leasing models, reducing virgin material use, and providing complimentary services throughout the lifecycle of a product.

“Executives will need to shift their mindsets to replace linear business models by decoupling growth from resource consumption,” said Jenny Davis-Peccoud, partner at Bain & Company and global head of the firm’s Sustainability & Responsibility practice.

She noted that companies have started by improving recycling and waste management. To accelerate progress, they will need to embrace new technologies and reconfigure their value chains.

Bain says circularity leaders monitor for turning points to assess the moments at which infrastructure, regulation, and consumer behaviour signal the acceleration of the circular economy.

As an example, in the electric vehicles industry, manufacturers’ growing portfolio of electric models and the development of charging infrastructure are both signposts of consumer acceptance. Being attuned to these developments enables executives to invest in circularity at the right time.

“In a world of increasingly impactful environmental regulation, raw material scarcities, trade tensions, and global supply chain disruptions, circular solutions can provide continuity,” said Hernan Saenz, partner at Bain & Company and global head of performance improvement practice.

He added that the ability to link circular strategies to business objectives and understand the industry’s future profit pools will be key to unlocking value.

"Executives need both the vision to imagine a circular future for their industry and the initiative to convert that into concrete action today,” he continued.

Three sources of circular value

Virgin material consumption rate: Companies making disposable or short-life products, such as plastic bottles, can create circular value by reducing the use of virgin materials and ensuring raw materials are recycled at the end of the product lifespan.

These businesses may find growth opportunities in reverse logistics and infrastructure businesses or supplying circular feedstock. Apple, for example, has developed disassembly robots to recover scarce materials like gold, cobalt, tungsten, and rare earth elements from used iPhones.

Product lifespan: Extending product lifespan is an effective strategy for high-value premium products that are both durable and easy to disassemble. These companies will adapt their business models to engage customers after product purchase and develop economical repair options, including right-to-repair guarantees.

Michelin is developing a tire re-tread business and tire-based services, which include on-site managers to perform health, safety, and maintenance checks.

Increasing product utilisation can create growth in enabling services and platforms, reverse logistics and infrastructure, and service-and-leasing models. For instance, Dell’s APEX offers customised packages of hardware, software, and cloud storage as a subscription service.