The financial services (FS) sector presently has a strategic opportunity to deliver a more sustainable and equitable revival in Hong Kong based on growing trust with the general public, says Gary Hwa, EY Asia-Pacific Financial Services regional managing partner and EY Global Financial Services Markets executive chair.

Despite the COVID-19 pandemic, Hong Kong’s FS industry has remained stable. The city benefits from its strong reputation as an international financial hub and financial services is an important pillar of the city’s economy.

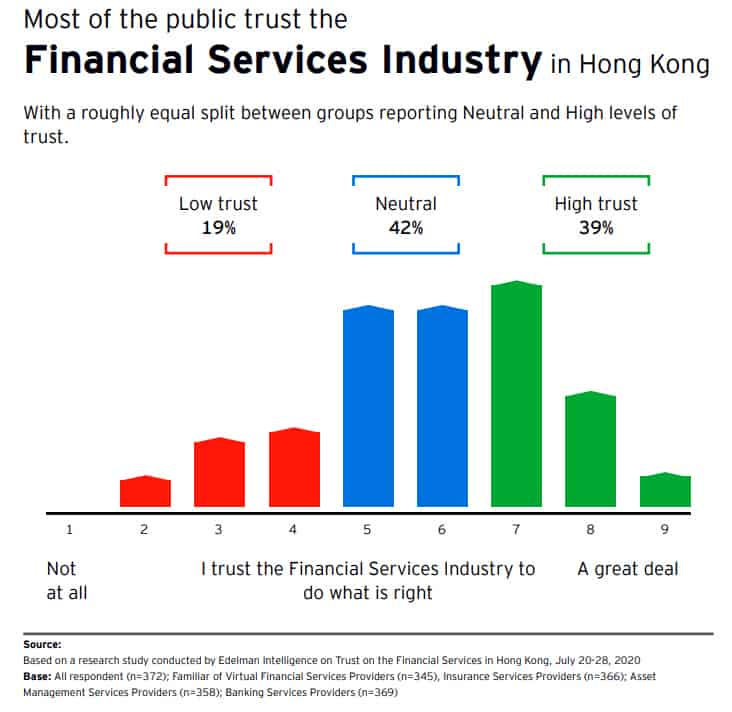

In a new report Trust in Financial Services in Hong Kong, EY teams conducted a survey of 372 members of the informed public to understand whether this resilient position correlates with strong public trust, and also to identify which ‘trust drivers’ the industry should focus on to improve trust levels from Hong Kong residents.

The report found that the FS industry starts from an overall position of relative strength among the Hong Kong public; with 81% of survey respondents stating that they trust or highly trust the industry. However, many areas for improvement were identified.

The EY report analysed the FS industry across four key measures of trust: Ability, Dependability, Integrity, and Purpose. The industry’s overall positive perception is driven by its ‘Ability’, reflecting competency in its products and services, and to some extent its ‘Dependability’ in keeping its business promises.

However, its performance weakened in the ‘Integrity’ pillar which highlights a need for providing more transparent information on its transactions, and in ‘Purpose’ which shows that it needs to do more to demonstrate a positive impact for society.

Be seen as more innovative

- Competence, rather than being innovative, is seen as the overriding strength of the FS industry in Hong Kong.

- Banking Services Providers are held in high-regard for delivering a stable business performance – 56% of respondents expressed high trust. However, they are not seen as innovative, despite their recent efforts and advancements in mobile and digital services.

- Virtual Services Providers are perceived favourably in relation to innovativeness, where they also outpace other sub-sectors of the industry.

However, this sector must also consider addressing public perceptions around the sector’s business performance (23%) and investing in building long-term relationships (25%) to change its seemingly ‘transactional-based’ image.

Increase communication touchpoints centred on contribution to society

- Insurance Services Providers are perceived to have an advantageous position because of the long-term relationships with customers. However, only 25% of respondents believe that these providers offer valuable advice, highlighting the need for more personalized advice services and product offerings.

- Disclosure is seen as a weakness for both Insurance Providers and Asset Management Service Providers, neither is seen to transparently communicate their fee structures (27% and 23% of respondents respectively).

- It isn’t surprising that among Virtual Services Providers, trust seems to be hampered by a lack of familiarity as the sector is still nascent with a handful of local players, yet it will help their capacity to build long-term relationships as they grow (only 25% of respondents think that they are good at this presently).

Act on societal issues and demonstrate concern

- Among Banking Services, the sector with the highest familiarity, only about one-third (32%) of respondents agree that the sector is doing enough to make a positive difference to society, especially around being vocal on social issues (22%) to build and maintain customer relationships.

- Further research from the 2020 EY Climate Change and Sustainability Services (CCaSS) Institutional Investor survey suggests that provision of more ESG strategy and information is increasingly important, with the majority of investors surveyed (98%) signalling that they will take a more disciplined and rigorous approach to evaluating companies’ nonfinancial performance in this area. To build trust, companies should consider following through and delivering against ESG commitments that they have communicated on.

Hwa acknowledged that Hong Kong’s FS sector has “displayed remarkable resilience” over the past year in the face of the COVID-19 pandemic, but to capitalise on and sustain the current overall high levels of public trust the industry should consider going further.

“Financial institutions here have a strategic opportunity to shape the recovery and the future economy in a way that may reframe the future to deliver a more sustainable and more equitable revival for Hong Kong,” he concluded.