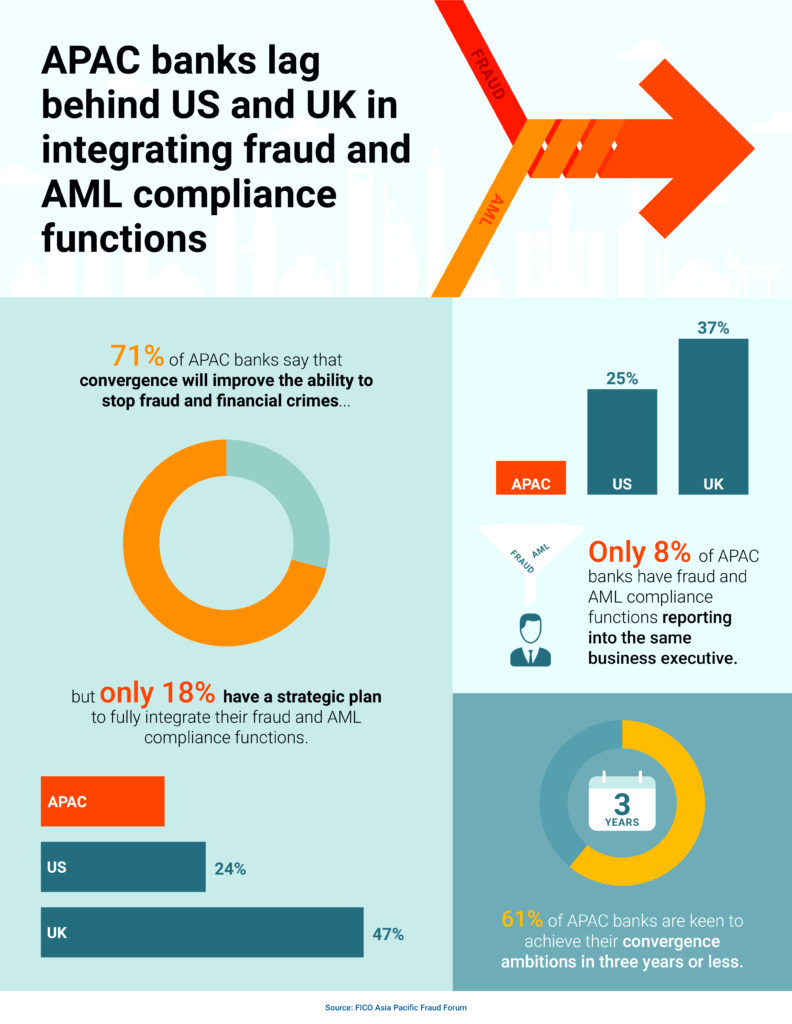

A survey by FICO revealed that only 18% of Asia Pacific (APAC) banks have a strategic plan to fully integrate their fraud and anti-money laundering (AML) compliance functions, even though 71% say that convergence will improve the ability to stop fraud and financial crimes.

An earlier survey commissioned by FICO in 2019, 24% of US banks and 47% of UK banks had strategic plans to fully integrate functions. FICO estimates that 80% of the functionality to do fraud checks and AML checks on a new account opening is the same.

Up to 38% of surveyed banks in APAC are actively looking at a more tactical approach, actively sharing resources where synergies exist. Examples of this being the sharing of data, controls or staff.

“What we are seeing in Asia Pacific is most likely the fast-follower mentality coming through. Many banks in region are closely watching those who are making the change overseas to see what lessons they can learn from first-movers before embarking on a similar program of change,” said Timothy Choon, FICO’s Compliance Lead in Asia Pacific.

When asked about current levels of integration, respondents admitted they currently had siloed operations. In terms of which areas currently operated separately or had low levels of collaboration, 95% nominated controls, 94% detection systems and 91% investigative systems.

In contrast, 82% of banks in the UK reported either full integration or a high level of collaboration for detection systems, and 76% for controls.

State of integration

Choon noted that overseas banks have moved to convergence sooner in response to new criminal threats and punishing fines.

“The same is happening in Asia Pacific but the pace has been slower due to different regulation, lower losses and a more fragmented market. The historical legacy of separate departments and leadership is also a factor, as there has been more change at the top overseas, which hastens the integration process,” he added.

Only 8% of APAC banks have fraud and AML compliance functions reporting into the same business executive. In the US about quarter of banks have just the one leader while European banks have 37% already integrated the functions under one manager.

| Top Areas | APAC | UK | USA |

| 1 | Reporting lines – 8% very integrated | Investigation systems – 53% very integrated | Data – 27% very integrated |

| 2 | Data – 3% very integrated | Detection systems – 35% very integrated | Investigation systems – 24% very integrated |

| 3 | Investigation systems – 3% very integrated | Data –24% very integrated | Controls – 24% very integrated |

Why so slow?

Choon said the vast majority of banks in the Asia Pacific understand the benefits of integrating their financial crime functions and don’t intend to integrate as tightly.

“Their timescales to achieve their plans are ambitious however, so in addition to watching for the best practices of the first-movers, they will also need to adopt the best of new breed of technologies that have been developed to work across fraud and financial crime,” he concluded.