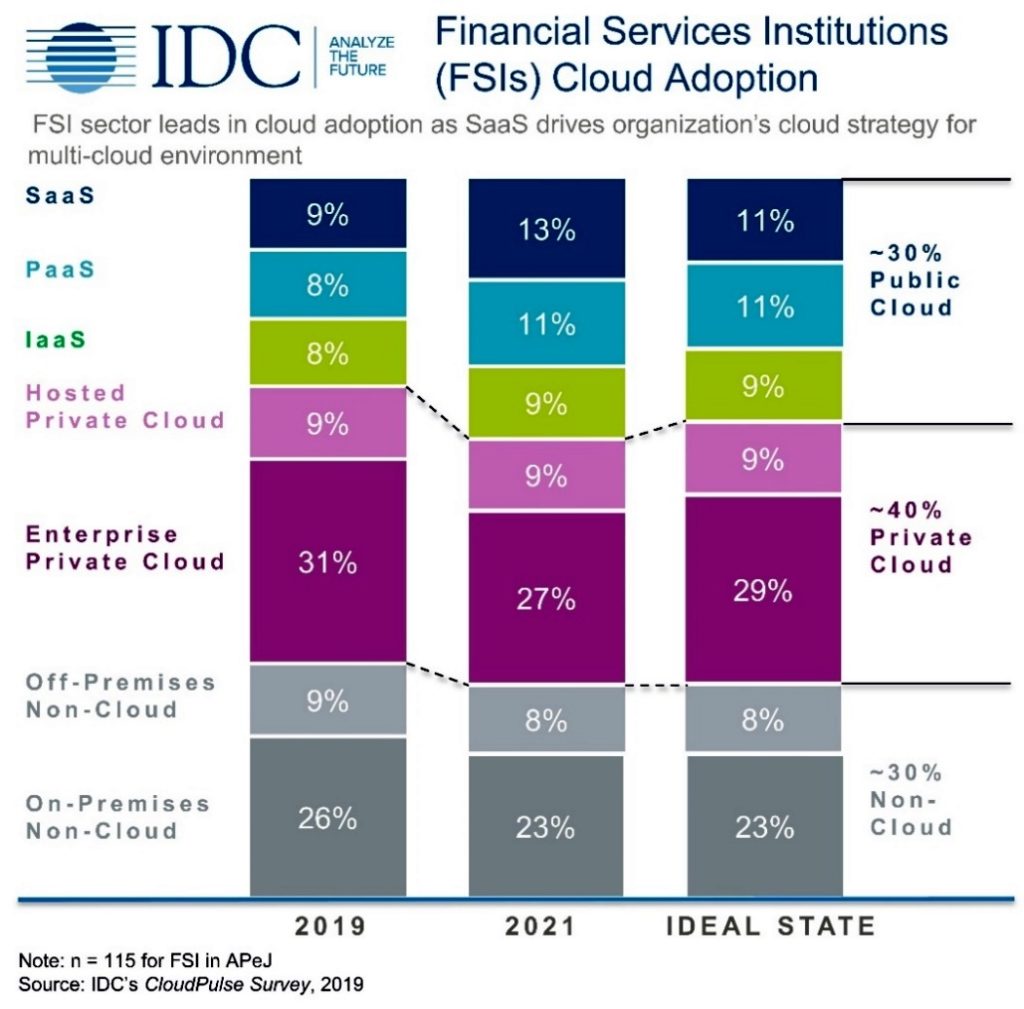

IDC expects the financial services institutions (FSIs) to seek cloud services as recourse should scalability and availability requirements increase. It anticipates an era of accelerated cloud adoption for the financial services industry in the region in the next few years.

IDC points to a confluence of greater willingness by banks to take on various models of cloud (private, public, and hybrid), increased regulatory clarity on cloud use by banks, and sheer growth in banking requirements (compute, storage, networking, and application workloads) that inevitably call for the cloud.

The IDC State of Cloud in Financial Services Industry for Asia/Pacific excluding Japan (APEJ) 2020 noted that public cloud is playing a critical role in the bank’s modernization efforts. More than 40% of APEJ FSIs already run workloads and IT jobs, either in part or in full, in a multitenant public cloud.

Additionally, close to 30% of the banks that are currently running workloads in the private cloud now plan to move a percentage of these to the public cloud – with some having firm plans to move within 24 months.

All about cloud

IDC predicts that the public cloud spend by APEJ FSIs will grow close to four times to US$13.9 billion in 2023 from a spend of US$3.6 billion in 2018, growing at a compound annual growth rate of over 30%. This spending reached US$5 billion in 2019. Despite the COVID-19 situation, we expect this growth to continue with a slight uptick.

William Lee, research director for IDC Asia/Pacific’s Cloud Services Research Program, said that cloud adoption has reached critical mass with 65% of FSI organization’s workloads reported to be in private and/or public cloud environments.

“Cloud is a significant component of the business transformation and innovation journey. With demand for cloud-based application development platforms and data management growing significantly in the region, leading FSIs are pushing hard to bring new offerings to the market and leverage developer capabilities in the areas of artificial intelligence (AI), machine learning, and internet of things (IoT),” Lee opined.

He added that hybrid multi-cloud strategy is becoming the new normal for many financial services institutions in Asia/Pacific.

The future is multi-cloud

“Going forward, we will see more examples of banks and other institutions that start to embrace the hybrid multi-cloud environment. The narrative is no more entirely focused on cost takeout, but also on the benefits of business agility, speed of innovation, scalability, manageability, and IT expertise as these advantages now become top of mind for the decision-makers," added Sneha Kapoor, research manager at IDC Financial Insights Asia/Pacific.

The resolve to move more workloads to PaaS and IaaS is becoming more evident. Kapoor pointed to the underlying benefits and opportunities with PaaS and IaaS have encouraged many institutions to make this move.

“Moreover, SaaS is already reaching a saturation point in the APEJ financial services industry. Other factors that are driving this shift include increasing trust in the cloud, unavailability of the right skill sets, and the move towards more critical applications. Having leveraged the SaaS model for some time now, institutions have now gained experience and confidence in modernizing more critical applications to adjacent models," she further elaborated.

Lee also discussed the significant decrease in non-cloud spending by the financial services institutions, especially banks, which has been largely driven by the shift in SaaS situations – where legacy applications were replaced by turnkey solutions provided by public cloud platforms. The decline has significantly benefited public cloud budgets.

With the steady stream of innovative new cloud services from major public cloud service providers to include a wide variety of AI-related services, blockchain services, IoT back-end services, AR/VR back-end services, robotics back-end services, encryption services, container services, serverless computing services, and new computing hardware services (GPUs, FPGAs, AI-optimized processors, and quantum computers), IDC expects the pace of IT innovation launches on public clouds will continue to accelerate.