The global survey, Digital Readiness and COVID-19: Assessing the Impact, by Tata Consultancy Services (TCS) revealed that large Asia-Pacific (APAC) firms are investing in digital transformation amid the pandemic.

KPI

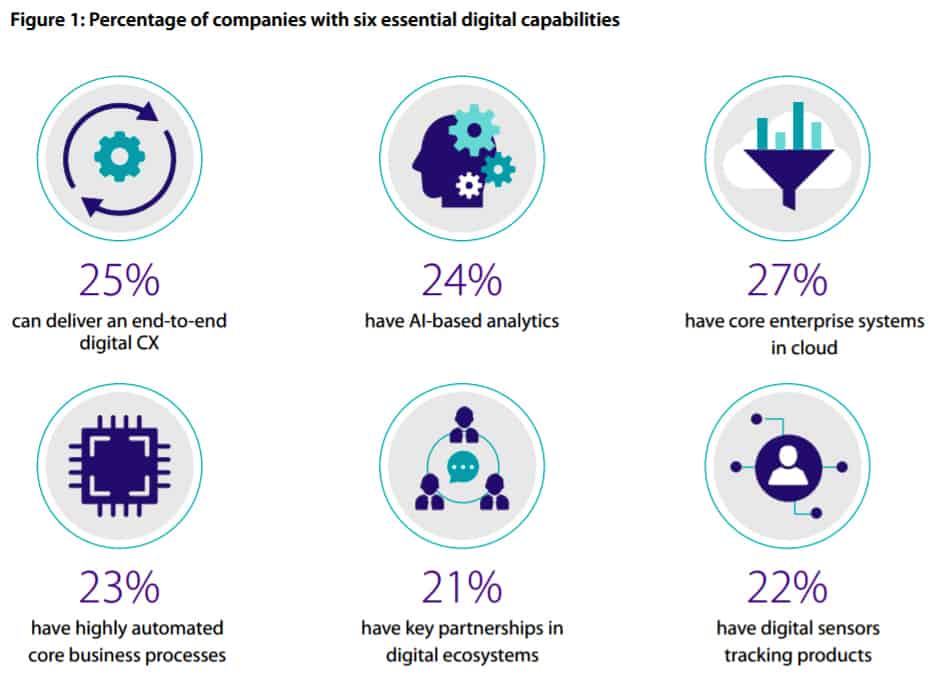

Six digital capabilities were identified as critical factors in companies withstanding the pandemic:

- End-to-end digital customer experience (CX)

- AI-based analytics to continually improve CX

- Core enterprise systems in the cloud

- Highly automated core business processes

- Digital sensors tracking products

- Key partnerships in digital ecosystems

Where APAC stands out

About 25% of APAC firms surveyed have these capabilities in place, with the region leading in using AI to improve CX, deploying core enterprise software in the cloud and automating core processes. Firms in the region are also actively investing in their less-developed capabilities, significantly outpacing companies in other regions in deploying digital sensors and developing key digital partnerships, and equalling Europe in developing end-to-end CX.

“With good digital readiness pre-COVID and a strong commitment to strengthening their capabilities, companies in Asia Pacific are setting themselves up to be better prepared to face the realities of a post-pandemic world,” said Girish Ramachandran, president, TCS Asia Pacific.

He added that with so many firms focused on deploying digital technologies, it will soon become apparent that having these digital capabilities will be a business imperative rather than a competitive advantage.

The survey found that organizations that had at least four of the six digital capabilities in place were less likely to report declining revenue due to COVID-19: 64% compared to 73% of “followers” with three or fewer capabilities deployed or in development and 68% of compared to the “vast middle” companies with more than three in capabilities either in place or in development. Moreover, digital leaders more optimistic, with 74% expecting revenues to bounce back within two years, compared to 54% of followers and 59% in the vast middle.

Remote work trend

Prior to COVID-19, the average company workforce primarily working from home was just 9% – now it is 64%. While most enterprises were able to effectively manage the initial shift to remote work, keeping remote workers productive and secure has been a real challenge.

Organizations have been enhancing their capabilities in collaborative technologies (65%), cybersecurity (56%) and cloud-native technologies (51%).

Globally, large companies expect that a good percentage of their employees will continue to work remotely after the pandemic—with about 40% working from home in 2025. If this holds true, about two-thirds of people currently working remotely will continue to do so for the long term.

Working from home is more likely for employees of Asia Pacific companies. On average, firms in the region expect 45% of their workforce to be working remotely in 2025, compared to 41% for European firms and 37% for North American enterprises. The industries most favourable to remote working post-pandemic include banking and financial services (44%), energy (43%) and manufacturing (41%).

Other Key Findings

- While 68% of companies globally have seen revenue declines due to COVID-19, 90% either maintained or increased their digital transformation budget.

- Globally, business initiatives around an end-to-end CX have seen most traction, already deployed at 25% of companies and under development at 44%.

- The use of analytics and AI to improve CX is deployed at 24% of companies and under development at 39%.

- Higher levels of automation in core business processes is another priority area, already deployed at 23% of companies and under development at 44% of companies.

- In APAC, cloud capabilities are a priority, with core software deployed in the cloud at 35% of enterprises and under development at 36%.

- About 28% of APAC companies have automated core processes and deployed AI to improve CX, with automation under development at a further 47% of companies and AI-driven analytics being developed at 38%.

- Only 22% of companies in APAC have deployed an end-to-end digital CX, compared to 29% in North America, but 50% of Asia Pacific companies are investing in digital CX compared to 38% in North America, indicating that the region will not be in catch-up mode for long.

- Globally, high-tech and insurance have the best digitization record: 22% of companies in high-tech and 16% in insurance are “leaders” that have deployed at least four of the six digital capabilities.