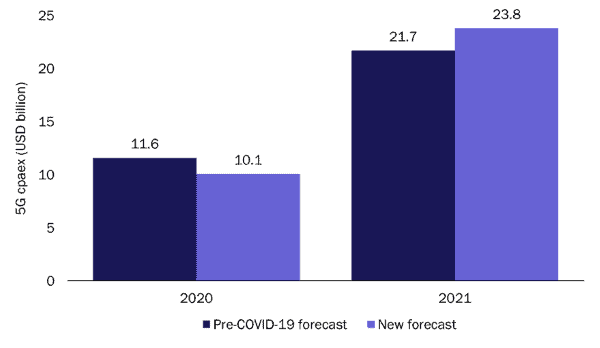

“Capex for 5G network will be 7% less than our pre-COVID-19 forecast. 5G Capex will bounce back in Q4 2020 and into 2021, and it will be 9.7% greater than our previous forecast for 2021,” said Caroline Gabriel at Analysys Mason.

Fitch Ratings predicts that the average revenue growth for the Asia-Pacific (APAC) telecoms sector will be flat to low-single-digit this year (2019: 4%), before recovering to pre-pandemic levels in 2021. However, credit risk remains manageable, reflecting the sector's resilience during the coronavirus pandemic.

The rating agency says the majority of the 20 companies on its portfolio are on Stable Outlook, with only six on Negative Outlook, of which half have close links with parents or are sovereign-support driven.

Fitch says it expects companies to manage balance-sheet strength through cost-cutting and capex management, including delaying 5G capex and reducing dividends. There are two contrasting patterns in the rollout of 5G in the region amid the pandemic; most markets have deferred discretionary capex to conserve cash or prioritise necessary capacity investment, while advanced markets, such as Korea, China and Singapore, are pressing ahead with 5G plans this year to lead technology innovation.

The pandemic's impact across the region depends on the severity of domestic lockdowns. Korean telecoms and Indonesian towers are the least likely to be affected due to recurring revenue.

The reliance of the Thai economy on tourism and the Philippines' on remittance may slow the recovery of the domestic telecom markets. This is in addition to the markets' predominantly large prepaid base, which is subject to greater cash flow volatility.

Fitch sees a gradual recovery from 2H20, as easing competition offsets weaker enterprise and international-roaming segments.

Fitch lays out its views on the key issues affecting the APAC telecoms sector amid the pandemic, including rating trajectories and downgrade risk, as well as revenue visibility for the sector against regional peers and the pandemic's influence on 5G rollout and competition.