Over the past few years, banks have focused on improving their digital services due to increased consumer demand – as well as the entry of digital-only challenger banks.

COVID-19 accelerated adoption of digital banking by customers. Customers turned to digital channels for all kinds of transactions, including the purchasing of banking products.

Earlier efforts by banks to improve their mobile channels – apps and websites – have paid unexpected dividends for customers during the Covid-19 pandemic, when visiting bank branches was no longer an option.

Hidden defection is growing

While deposits and core current (checking) accounts generally remain at customers’ primary banks, they are losing customers on high-margin products such as loans, credit cards and investments -- those that better suit their needs.

However, the Bain & Company study, As Digital Banking Takes Off, Hidden Defection of Consumers is Rampant, showed that the defection ranges from between 25% to 51% of all banking product purchases going to banks that are not the surveyed customers’ primary bank.

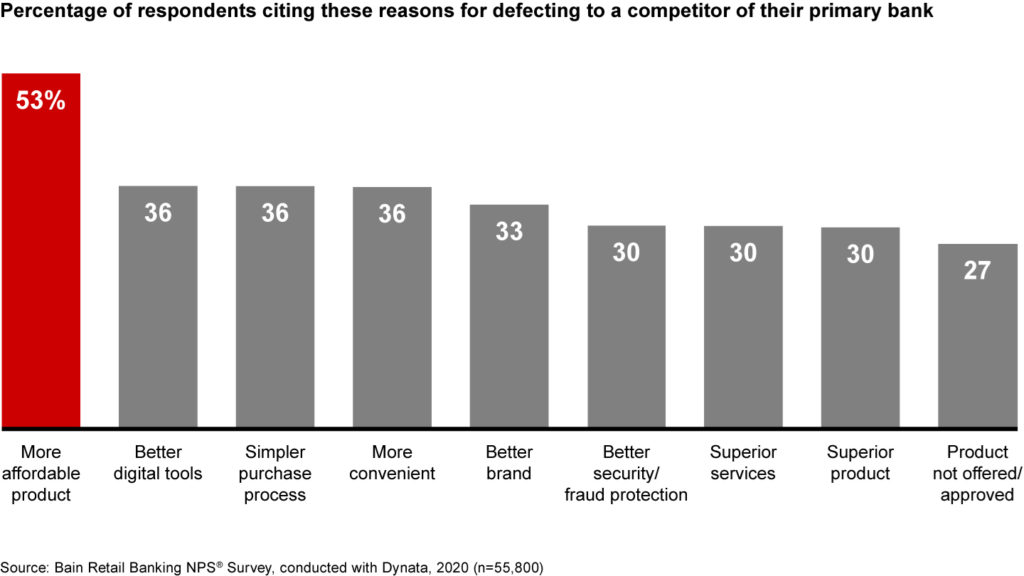

“We surveyed more than 56,000 consumers in 11 countries and found that while respondents most frequently cited affordability of a competing offer as their reason for purchasing products from another bank, they also cited better digital tools, a simpler purchasing process and convenience as key reasons,” said Katrina Cuthell, a partner with Bain & Company in Sydney and a co-author of the report.

“These numbers were higher among younger customers, who put an even greater emphasis on digital tools, convenience, branding and security.”

China leads the trend in Asia

The UK, which has one of the most competitive banking markets in the world, has the highest defection rate of the 11 countries surveyed. As consumer-friendly, “open-banking” types of regulation take hold in more countries, competition in those markets could intensify as well.

China’s banking customers are following suit and showing that Asian banks too have the potential to experience the same phenomenon.

If current trends hold, hidden defection will likely intensify in many countries due to the spread of regulations, which will make consumer data portable and thus encourage competition.

“We saw that while some respondents actively search for product options, others respond to ads, with 29% of those who defected receiving a direct offer from a competing bank. Of the latter group, 78% said they would be willing to buy from their primary bank if it made a compelling or equivalent offer,” said Gerard du Toit, a Boston-based partner with Bain & Company and the leader of the firm’s global Customer Experience practice.

“In order to halt the current defection of customers, banks will need to remove the friction that exists in their marketing so consumers won’t feel compelled to shop around, and excel in the basics of opening accounts, so prospective buyers don’t drop off.”