Juniper Research has found that 53% of the world’s population will access digital banking services in 2026; reaching over 4.2 billion digital banking users, from 2.5 billion in 2021.

The research identified increased digital transformation efforts as enabling banks to function effectively during the pandemic, justifying the benefits of digital banking use and fostering further user growth.

The Banking-as-a-Service business model

The Juniper Research report, Digital Banking: Banking-as-a-Service, Market Transformation & Forecasts 2021 2026, identified that China will be the largest digital banking market over the next 5 years; accounting for almost 25% of digital banking users in 2026.

The research recommends that banks should better integrate their many offerings into a single, consistent digital experience, to better compete with the diverse competition.

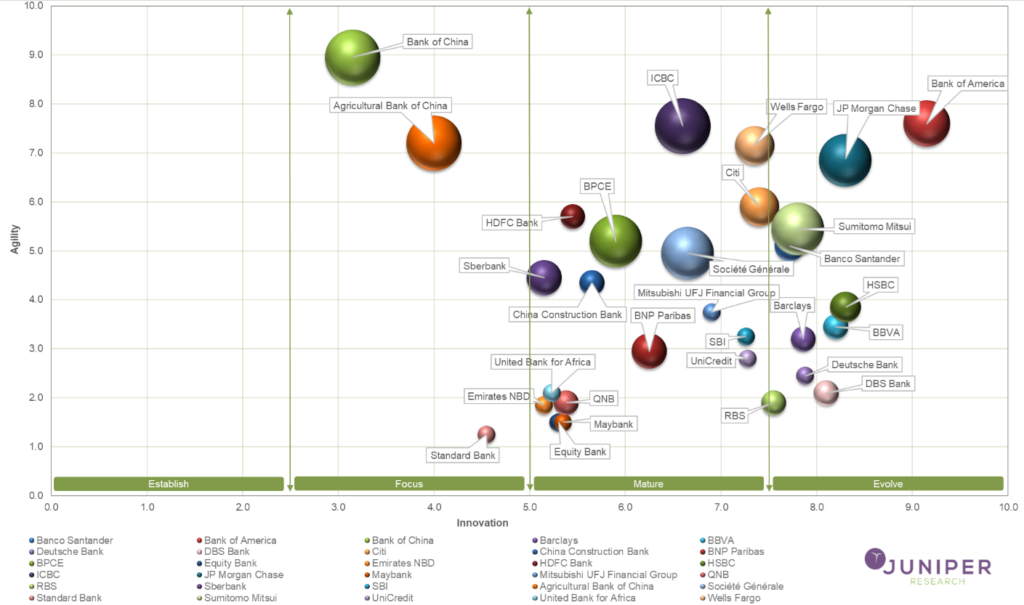

It identified the leading group of banks for digital transformation:

- Bank of America

- HSBC

- JPMorgan Chase

- BBVA

- DBS Bank

Bank of America offers an ever-expanding digital platform, including the Erica chatbot, and has had recorded significant upticks in digital usage and engagement during the pandemic. JPMorgan Chase has experimented with blockchain and has made acquisitions, such as that of wealth manager Nutmeg in the UK to boost its offerings. HSBC has launched innovative new solutions, such as HSBC Kinetic for small businesses in the UK, with BBVA launching initiatives including cryptocurrency trading and DBS Bank having high levels of digital engagement.

Research co-author Damla Sat noted: “These banks have progressed with well-planned and executed digital transformation strategies, and other banks need to build similarly broad and revolutionary roadmaps, or they will be left behind by more agile competitors.”