Laura J Hay, global head of insurance at KPMG International says the COVID-19 has put insurers on the fast-track to technology adoption.

“Beyond remote working and the digital way of working, the pandemic has triggered a drive to accelerate business innovation, including shifting from physical to digital channels and products, with end-to-end automation and optimisation of processes from intake through to claims,” she opined.

Following the launch of its Chubb Studio platform, an initiative marketed as a means to simplify and streamline the distribution of insurance products, FutureCIO spoke to Roopa Malhotra, head of Digital for Chubb Insurance Asia Pacific, for her views on how COVID-19 and digitalisation is changing the insurance landscape.

What are some of the most critical risks that on-going digitalisation efforts in Asia are creating, and which industry groups are least prepared (most vulnerable)?

Roopa Malhotra: Digitalisation has and will undoubtedly open various opportunities and innovations to meet the evolving needs of the consumer and how we interact, distribute, and service them.

However, it does bring newer challenges and risks particularly around redefined workforce in shared economy, as well as cyber risks that both consumers and corporates are going to face in unprecedented ways.

Digitalisation is enabling corporations to tap into the shared economy and have efficiently matched the underutilised and untapped resources with their needs.

This shift outside of the traditional employment relationship in the shared economy has caused a boom in the number of people working as self-employed riders for food delivery and ride-sharing, and a younger generation preferring freelancing model over traditional employer-employee relationships.

However, workers in the shared economy are often the most vulnerable as they are usually uninsured, unlike people in a traditional employment relationship.

This means that they will face risks such as a loss of income and hefty hospital bills if they were to encounter an accident that causes them to be hospitalised. Consumers and sharing platforms often have opposing views on who bears the responsibility for this form of protection.

Different countries have different regulations and the authorities are currently reviewing those shifts.

Similarly, with the abundance of SMEs in Asia and their push to be digitised, they are increasingly exposed to cyber threats. For most SMEs, this can often be a much lower priority to worry or some assume that their general package insurance also covers cyber protection.

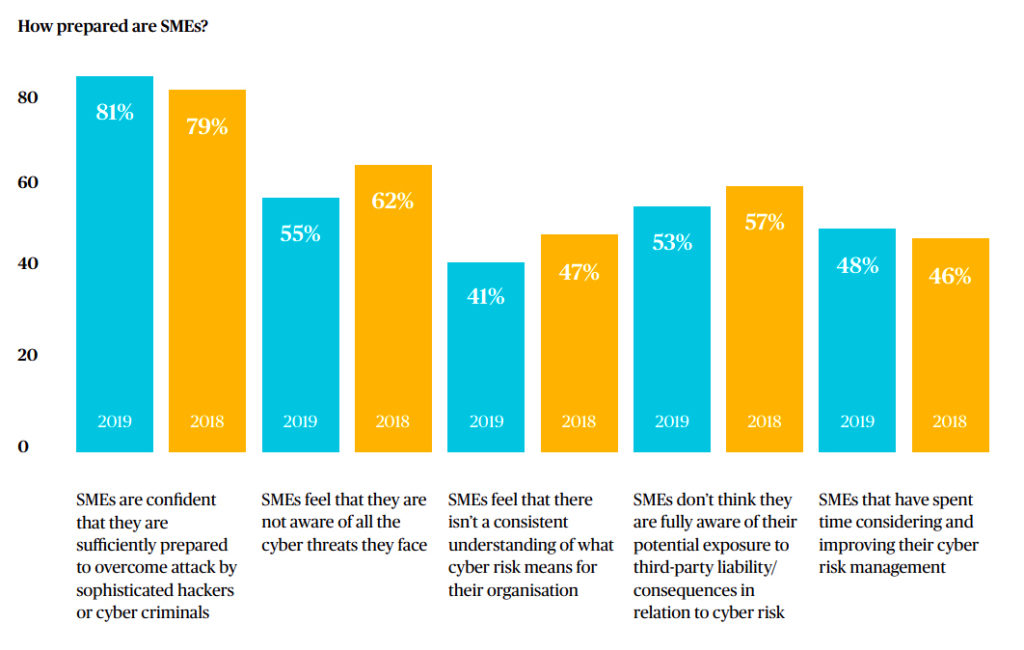

A 2019 survey by Chubb of Small and Medium Enterprises (SMEs) across Australia, Hong Kong SAR, Malaysia and Singapore has found that more than half of SMEs in Asia-Pacific are unprepared to manage cyber risks.

Do owners/leaders at these organisations understand the risks? So why pursue?

Roopa Malhotra: Businesses in the shared economy are starting to recognise their responsibility as platform providers. However, few are taking actions as there are no clear or sufficient regulatory framework guiding them.

There is also a lack of understanding of the insurance products available in the market as well as general lack of sufficient insurers covering these risks, leading to higher upfront costs.

The COVID-19 pandemic has surfaced certain risks and put them under the spotlight. Experts are warning of more cyberattacks as more people are shopping online and working from home.

The shared economy has attracted more drivers as jobless and furlough rates increased. These developments have indirectly increased greater awareness of the risks.

How does insurance figure into this risk strategy?

Roopa Malhotra: As digital ecosystems continue to define the economic activity and blur the borders between market sectors, insurance is a highly relevant product for nearly all B2C and B2B channels.

Insurance providers like Chubb can help businesses understand and adapt insurance coverages that meet the need of these newer platforms. Insurance can help improve the customer experience for their partners by reinforcing trust and loyalty through –

1. Tailoring the right insurance products and offering them at the right price, at the right time and in the channel preferred by their customers.

2. Delivering the service in a timely manner.

3. Paying the claims timely and easily through online channels.

For cyber, insurance providers need to work hand in hand with cyber risk mitigation companies and offer coverages that not just help in responding to a cyber threat but also prepare the organisations to mitigate them.

Specific to micro-insurance and the risks associated with digitalisation, how does it work? Who is it delivered/executed?

Roopa Malhotra: Collaborating with distribution partners who have the reach with the unbanked population, micro-insurance presents consumers with low entry, cost-effective insurance protection tailored with simpler coverages that meet their most critical needs.

To offer micro-insurance products, insurers need to have scalable and agile platforms that can integrate with these partner platforms seamlessly.

At Chubb, we are doing this via our Chubb Studio platform, providing partners the option for insurance to be offered as needed via a website, widget or preferably with a deep integration for best customer experience.

The technology also allows businesses to sell insurance in minutes with either their own brand, co-brand or Chubb's branded offering to reinforce trust in their own brand or a reputed insurer backed offering as deemed fit and allowed in the regulatory environment.

COVID-19 may have an extended impact (period-of-time) but it isn't forever. What happens when the pandemic is no longer a threat to business and people?

Roopa Malhotra: When the pandemic ends, businesses are unlikely to be returning to the old ways. The silver lining of COVID-19 is that it has forced every industry to an accelerated digital transformation.

It has brought into focus the importance of operational capabilities to distribute products digitally through other channels, including ecosystem integration with other industries.

While the COVID-19 situation continues to evolve, it is difficult to ascertain the aftermath of the pandemic.

However, we foresee an increased demand for digital solutions on both distribution and servicing and the need for more hyper-localised coverages, as businesses continue to innovate and grow outside of their traditional core business and build resilience to their operations.