Part of the CIMB Group, CIMB Bank Philippines (CIMB Bank PH) markets itself as an all-digital mobile-first consumer bank in the Philippines. With a Commercial Banking License issued by the Bangko Sentral ng Pilipinas (Central Bank of the Philippines), it claims to have 1.8 million sign-in customers during its first year of operation (2019), with 30% being first-time bankers.

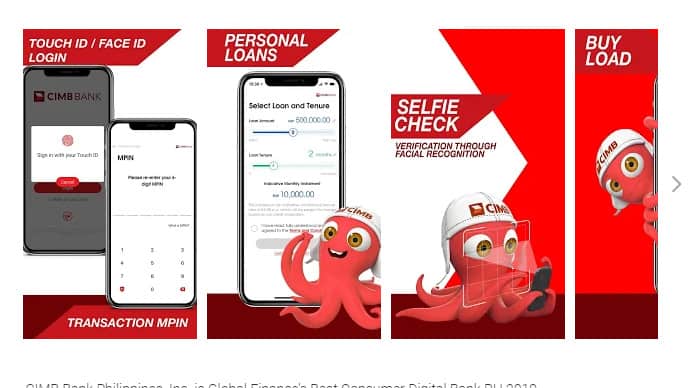

The digital bank claims it only takes 10 minutes to open a safe and secured account, and 10-minute approval response for personal loans up to Php 1 million.

Processing an application to open a bank account typically involves verifying the identity of the customer and ensuring the necessary documentation is supplied and verified. Additional cross-checks, including for anti-money laundering compliance, usually come in when accounts reach a specific threshold.

Helping CIMB Bank PH speed customer onboarding process is Jumio, a provider of AI-powered end-to-end identity verification and authentication solutions. The vendor’s identity verification solution uses machine learning, AI, certified liveness detection and face-based biometrics to ensure the person behind a digital transaction is who they say they are by matching a user’s live selfie with the photo shown on their government-issued ID.

“Our partnership with Jumio has been integral in achieving our milestones so far as an all-digital bank in the Philippines to deliver a safe and secure banking experience,” said Vijay Manoharan, CIMB Bank PH CEO.

The collaboration provides Filipinos with a safe and seamless onboarding experience, while still holding high standards of data privacy and meeting local compliance requirements.