Although higher than pre-pandemic levels, the levelling of online activity since Wave 2 of Experian’s Global Insights Report (mid-September 2020) means businesses need to shift their focus to address these changing consumer needs and establish trust when it comes to communicating how they utilise personal information and data protection.

As industries grapple with pandemic recovery, the report uncovered numerous findings to help businesses improve the digital experience for consumers:

Rise of digital payments

Mobile wallets have become the most popular payment form in the APAC region, with the highest levels of online activity found among consumers in India (80%) and Singapore (69%). In Japan, the use of mobile wallets is also strong, but particularly for 63% of consumers with a higher household income (greater than US$100,000) – significantly above the 39% for the general population.

Retail apps are the second most used digital payment method across four APAC countries, led by India (64%) and Singapore (60%) consumers.

However, concerns around fraud and security remain high as consumers become more reliant on digital payment methods. Globally, top concerns are stolen credit card information (33%), online privacy (32%), identity theft (32%), and fake/phishing scams (31%).

Regionally, security is the most important factor when it comes to consumer online experience – this is especially high in Japan (89%), Australia (83%) and Singapore (82%).

Importance of safeguarding consumers personal information

Consumers care about high levels of security and data protection when transacting online. More than half across APAC would like to be informed about how their personal data is being protected and stored – in fact, consumers in India (79%) and Singapore (70%) have the highest need to know why their data is being requested than prior to COVID-19.

As such, consumer trust will be won by businesses that can successfully deliver against consumer privacy protection and get access to a wider range of personal consumer data.

If they trust the business, 56% of consumers globally will share their contact information and 42% will share their personal information – a rise in comparison from the 52% and 40% for both respectively from the previous study.

The need to establish trust is high so that businesses can turn this information into actionable insights, growing their business while meeting changing customer needs.

The key remains to find the balance between ensuring the appropriate security measures are inserted into the process, without impacting the customer experience.

Experian Asia-Pacific CEO Ben Elliott says as consumers become more worried about their wider digital footprint which comes with greater exposure to security risks, businesses must instil confidence in how they are protecting customer data and how it is being used.

He acknowledged that while this is not a new concept, the importance of customer data protection is increasingly paramount for businesses across the region as consumers expect this to be the minimum standard.

Best practices adopted by businesses in the digital age

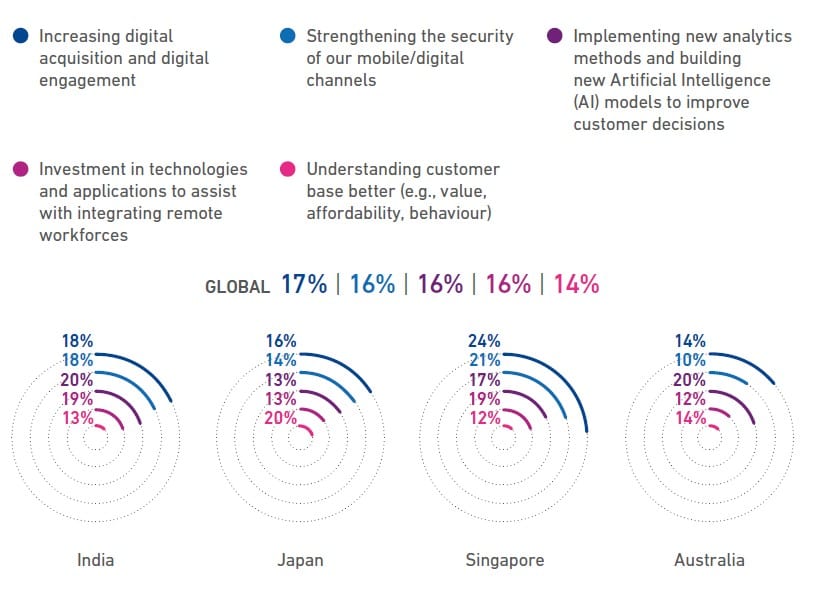

APAC businesses recognise the importance of the customer journey, as more turn to technology to generate positive customer outcomes and experience.

Today, 70% of global businesses say they’re talking about advanced analytics and customer credit frequently – in fact, investment in advanced analytics to reduce friction during digital customer experience is a top priority for the Singapore market (45%).

The adoption of AI and machine learning has significantly increased on a global scale. AI is up 74% from 69% in 2020, and machine learning is up 73%, from 68% in the same period. India is currently leading with the most businesses implementing AI (87%) and machine learning solutions (83%).

Businesses may struggle to find the funds for additional investment, as more say they need better access to loans and credit, compared to a year ago. Globally, 64% of businesses say they have applied for new loans or extended credit of less than 10%.

As the consumer landscape continues to evolve, digital investment is going to be the key differentiator for businesses, and those that lag in doing this today may lose future customers and opportunities to win their trust.