“All the tools and advances in the world will not stop illicit activities if people in positions of authority chose to ignore these.”

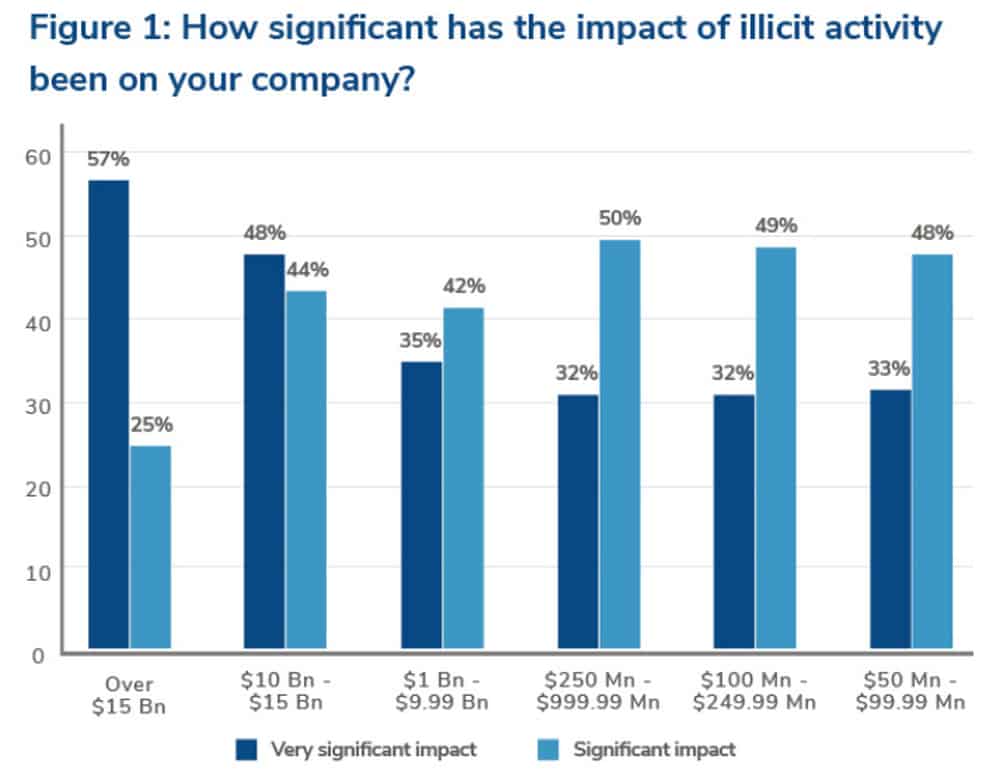

According to Kroll, 57% of respondents at US$15+ billion turnover companies reported “very significant” impacts of corruption and illicit activity. This despite, 86% of surveyed respondents claiming to use proactive data analytics to mitigate risks.

What’s up in China

In China, 29% of respondents ranked employees’ actions as the top threat related to bribery and corruption risk, the highest percentage of all countries surveyed.

Among Chinese respondents, 34% cited weaknesses in record-keeping as their top concern, higher than the global average of 31%. 29% cited employees’ actions as a cause for concern while 37% said it was a lack of visibility over third parties.

Powerless Board

Kroll’s Global Fraud and Risk Report noted that despite 72% of respondents claiming bribery and corruption issues were being given sufficient board-level attention and investment, 82% overall still felt corruption and illicit activity were having a significant impact on their organisation.

Violet Ho, senior managing director and head of Greater China, forensic investigations and intelligence, commented that 2020 was a challenging year for corporates, with organizations around the world facing threats from all angles, including increasingly complex supply chains and the impact of the global pandemic.

The continued rise in bribery and corruption threats necessitates asking why the practise continues despite the proactive use to mitigate these.

“Our survey highlighted that organizations are feeling vulnerable to both internal and external threats such as poor record-keeping and lack of visibility of third parties. The human factor is also a key component – even the best compliance programs can be ineffective if the appropriate education, training, company culture and tone from the top aren’t employed,” he concluded.