At a time of uncertainty and rising inflation, consumers are focused on how to extend every dollar. At some point, they will notice the shrinking packaging of a preferred brand.

A Gartner survey of 252 consumers in June 2022 found that shrinkflation— when the size or quantity of packaged goods is reduced without a commensurate price cut — is viewed as more prevalent than skimpflation — erosion in the quality of a product by using cheaper ingredients or components, or a reduction in a service, such as longer delivery times.

The survey revealed that 62% of consumers say they'll stop buying from brands that change product size (“shrinkflation”) or quality (“skimpflation”) to cut costs. Only 7% said they would continue purchasing from a brand that cut costs in this way.

“Brands make strategic decisions to optimize costs by changing packaging, ingredients, suppliers and service offerings all the time,” said Kate Muhl, vice president analyst in the Gartner Marketing practice. “Not all of these actions are perceived by consumers to be deceptive business practices, or perceived to be happening at all.

She cautioned that in a period of unprecedented inflation, consumers are on high alert and noticeable changes that impact the value proposition of a brand’s product or service are more likely to result in harm to that brand.

“CMOs can lead by directing teams to emphasize continuity and value. If needed, they should look to cut services (a form of skimpflation) rather than product amounts.”

Kate Muhl

Numbers: a cautionary tale

Seventy-five per cent of consumers expect prices to continue to increase in the second half of 2022, and 65% of consumers expect to cut back on purchases or stop buying altogether in at least one product category.

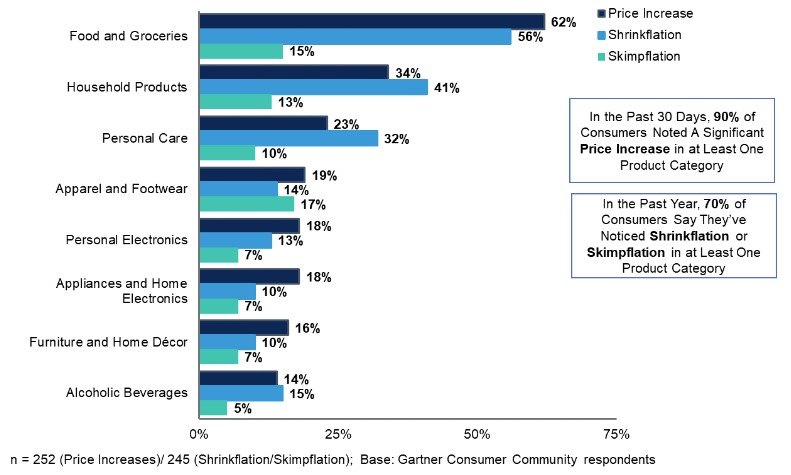

Consumers noticed the most significant price changes in the “food and groceries'' category (62%). Forty-one per cent of consumers noted “household products” suffered from shrinkflation, while 32% of consumers noted that “personal care” products suffered from it (see Figure 1).

Figure 1: Where Consumers Notice Price Increases, Shrinkflation and Skimpflation (% of Respondents)

Consumers differ on what businesses should do to limit price increases, but one suggestion stands out from other ideas: 45% said that companies should stop increasing the pay of high-ranking executives.

“Executive compensation decisions can harm brands, especially in inflationary periods,” noted Muhl.

CMOs looking to address consumer concerns around price increases, shrinkflation and skimpflation can explore the following near-term actions:

Message on what hasn’t changed. CMOs at brands that retain product quality and quantity despite inflationary pressures should ensure that brand messaging highlights commitments to continuity in price, ingredients, or suppliers. CMOs should design this messaging to combat the widespread perception that all products have been subject to shrinkflation, even if that isn’t the case for their brand.

Amplify value proposition with functional benefits that save consumers money, such as the durability of big-ticket items, and lean in on thrift-related market product attributes that consumers increasingly care about.

Offer tech alternatives to staffed services without dramatically impacting the customer experience. Retailers, restaurants and other service-oriented brands may find that cutting back on staffed functions is more palatable to consumers than the product tweaks that consumer product goods (CPG) brands try, even though the former is also a form of skimpflation.