According the EY CEO Imperative Study 2021 the COVID-19 pandemic has moved digital-lead business transformation initiatives from important to urgent.

CEOs acknowledged the importance of human factors to the success of their transformation projects, with 68% of respondents saying they have at least one transformation priority covering people, the cultivation of future talent and organizational culture.

Andy Baldwin, EY global managing partner – client service, commented that during 2020 CEOs have had to make tough decisions by reviewing portfolios and projects to balance the long-term growth prospects against immediate shareholder expectations.

“Technology has been the common denominator for most organization’s resilience amid the pandemic. Interestingly, the traditional and analogue businesses, that were initially struggling at the start of the crisis, have accelerated the adoption of new digital technology and led the spending on tech and data. We are now seeing more of a hybrid business model as CEOs continue to seek to plan for any future partial or full lockdowns,” commented Baldwin.

He added that businesses are shifting their focus to assess how they can “win-in-turn” and this is driving investment plans over the next 12 months.

Data trust gap threatens transformation, competitiveness

As data security and privacy regulations move to the forefront of public discourse, there remains a considerable trust gap between the capabilities of intelligence technologies and what people are willing to let these innovations do.

Only 34% of respondents affirm that customers trust them with their data, reinforcing the need for CEOs and the C-suite to scrutinize processes around data collection, management and use, while increasing transparency with customers and other stakeholders.

If left unaddressed, this issue could limit growth, slow innovation and stall transformation efforts.

Despite this gap, 88% of respondents state that the use of data science to anticipate and fulfil individual customer needs will be a main differentiator in the next five years; while 87% of respondents say delivering data-driven experiences will drive competitive advantages during the same period.

In the more immediate term, 41% of respondents believe artificial intelligence (AI) and data science requires increased attention from the C-suite over the next 12 months.

Wide disparity when it comes to transformation priorities

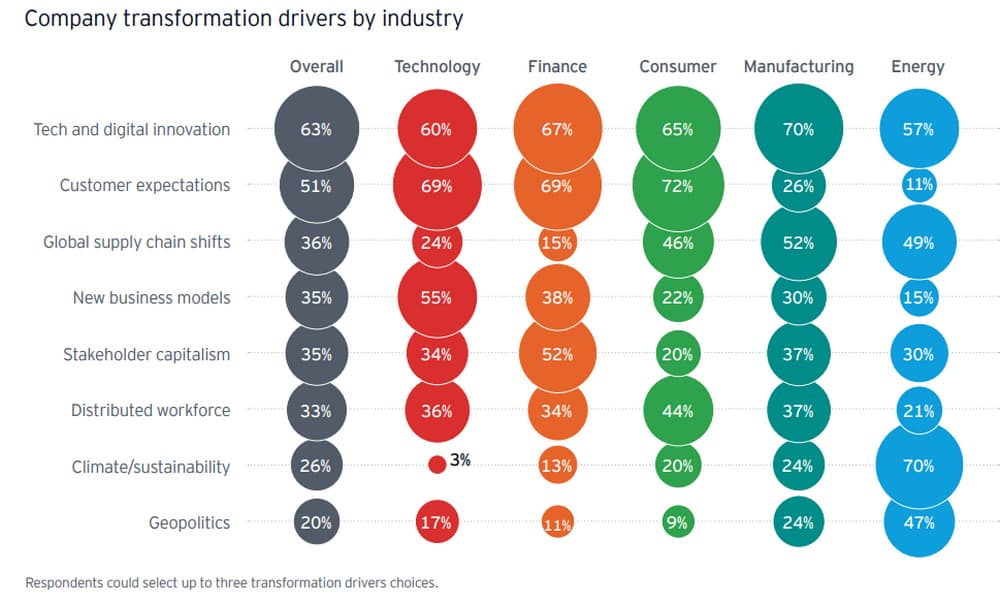

While digital innovation was the top transformation driver overall and the greatest area of increased focus to generate growth, there were important distinctions among different sections.

Most notably in the Energy sector, where less than one-third (32%) of respondents believe digital transformation requires attention.

Respondents within the Energy sector are more focused on climate change and geopolitical risk. In the Finance sector, just over half (51%) of respondents were focused on digital, while two-thirds (67%) look to cybersecurity.

The starkest divide is in the area of long-term value, where 69% of respondents in the Manufacturing sector believe this is where their focus should be, compared with just 17% of respondents in the Technology sector.

The long-term value creation “say-do” gap

The research found that over the next five years, 87% of respondents believe the creation of long-term value across stakeholders will be welcomed and rewarded by the market, while 91% of respondents believe new business models will increasingly incorporate aspects of the circular economy.

Alongside this, 80% agree there is likely to be a global standard for measuring and reporting long-term value creation and 80% agree that their organizations will take significant new steps to take environmental, social and corporate governance (ESG) responsibility inside their operations.

However, analysis of responses against key long-term value dimensions such as societal, human, financial and customer, revealed a clear “say-do” or intention-action gap.

DNA of the future enterprise

The research found leaders face key capability and execution gaps, with actions failing to meet intentions when it comes to generating long-term value, changing organizational structures from inhibiting agility, and sluggish investment in ecosystems hampering resilience. Addressing these gaps will require a top-down strategy focused on three interconnected value drivers:

Placing humans at the centre of everything the organization does, increasing agility to react to changing market and consumer demands.

Technology at speed, empowering organizations to deploy new solutions faster.

Innovation at scale, collaboration among organizations across an ever-increasing ecosystem to move into new markets.

By focusing on these value drivers, CEOs can reorient their organizations around a culture built for continuous transformation and set their businesses up to outperform competitors in the short-, medium- and long-term.

“While the research highlights that CEOs are willing to transform, EY data found a clear gap between intention and execution particularly when it comes to long-term value and ESG. Given the sense of urgency around these issues is only increasing, CEOs will come under greater regulatory and reputational pressure to operate differently. Leaders need to follow through their public commitments with action to demonstrate they are taking the bold steps needed to drive long-term value and change,” concluded Baldwin.