Gartner forecasts global spending on artificial intelligence (AI) software to total $62.5 billion in 2022, up 21.3% from 2021. However, despite picking up speed its long-term trajectory depends on enterprises advancing their AI maturity, warned Alys Woodward, senior research director at Gartner.

The AI software market encompasses applications with AI embedded in them, such as computer vision software, as well as software that is used to build AI systems. Gartner’s AI software forecast is based on use cases, measuring the amount of potential business value, timing of business value and risk to project how use cases will grow.

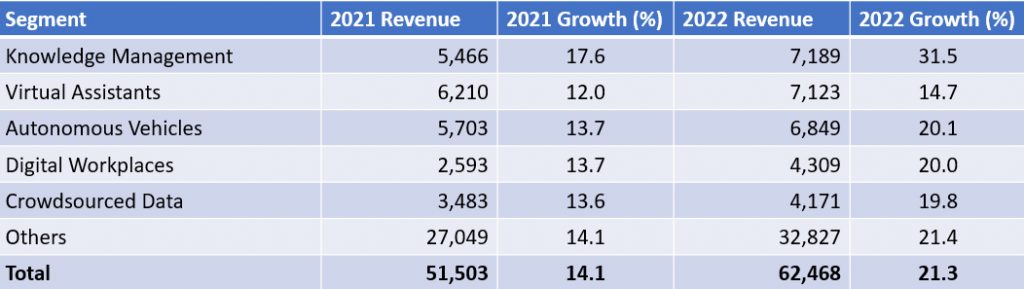

Gartner forecasts that the top five use case categories for AI software spending in 2022 will be knowledge management, virtual assistants, autonomous vehicles, digital workplace and crowdsourced data (see Table 1).

Table 1. AI software market forecast by use case, 2021-2022, worldwide (millions of U.S. dollars)

Woodward said successful AI business outcomes will depend on the careful selection of use cases. “Use cases that deliver significant business value, yet can be scaled to reduce risk, are critical to demonstrate the impact of AI investment to business stakeholders,” said Woodward.

AI Maturity lags behind interest

Demand for AI technologies and associated market growth is closely tied to organizational AI maturity levels. Enterprises continue to demonstrate a strong interest in AI, with 48% of CIOs in the 2022 Gartner CIO and Technology Executive Survey responding that they have already deployed or plan to deploy AI and machine learning technologies within the next 12 months.

The reality of AI deployment is much more limited. Gartner research found that organizations commonly experiment with AI but struggle to make the technology a part of their standard operations.

Gartner predicts that it will take until 2025 for half of organizations worldwide to reach what Gartner’s AI maturity model describes as the “stabilization stage” of AI maturity or beyond.

Advances in AI maturity will increase AI software revenue due to increased spending, particularly across the data and analytics-related technology category. A lag in maturity — caused by reluctance to embrace AI, lack of trust in AI and difficulties delivering business value from AI — will have a corresponding deceleration effect on spending and revenue.