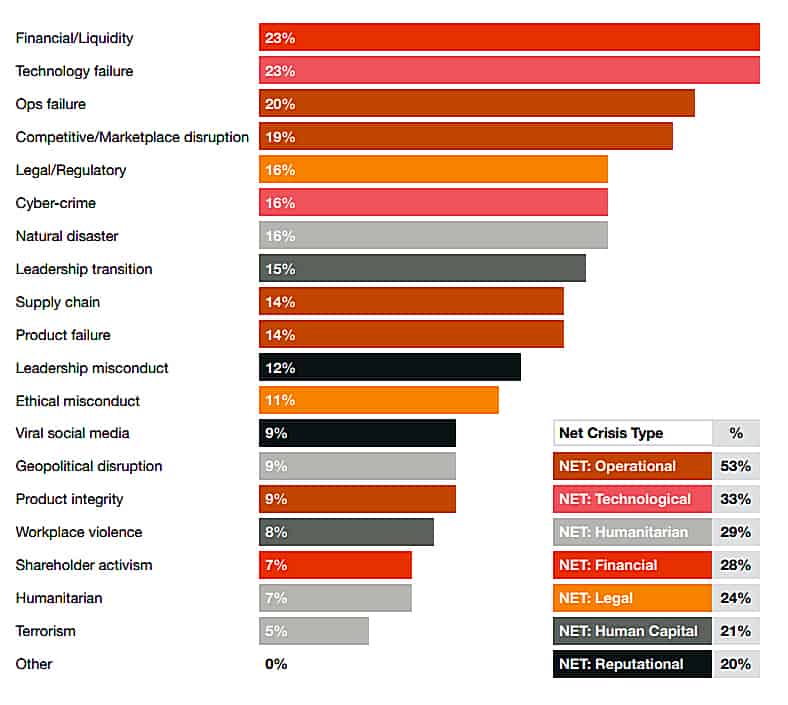

In August 2019, PwC published its Global Crisis Survey in which only 5% of the more than 2,000 companies surveyed globally said they do not expect a crisis in the future. For those who have, financial liquidity and technology failure topped the list of crisis experienced by executives of the survey.

Figure 1: Crisis triggers/types experienced

Source: PwC Global Crisis survey of 2084 respondents

Four months after the publishing of the PwC report, we are on the brink of a new crisis – one characterised by rapid escalation, indiscriminate targeting, and as borderless as the digital transformation that has been sweeping the world since 2018.

Once again businesses are facing a corporate crisis, with a few add-on complexities.

For us in Asia, it has many faces: an on-again, off-again China-US trade war, no-end-in-sight Brexit, and now COVID-19 outbreak.

With Asia seen as the region seen as the economic centre for the 21st century and China the origin-point for the COVID-19 outbreak, it is not surprising that businesses and governments of all sizes are struggling to figure out strategies to help them ride the seemingly unending train of disasters that are rolling across the region.

“Companies today face an unprecedented number of potential challenges. As business leaders, we cannot direct the wind, but we can adjust the sails when it comes to dealing with disruptions to operations,” said Lennard Yong, group CEO, Tricor Group.

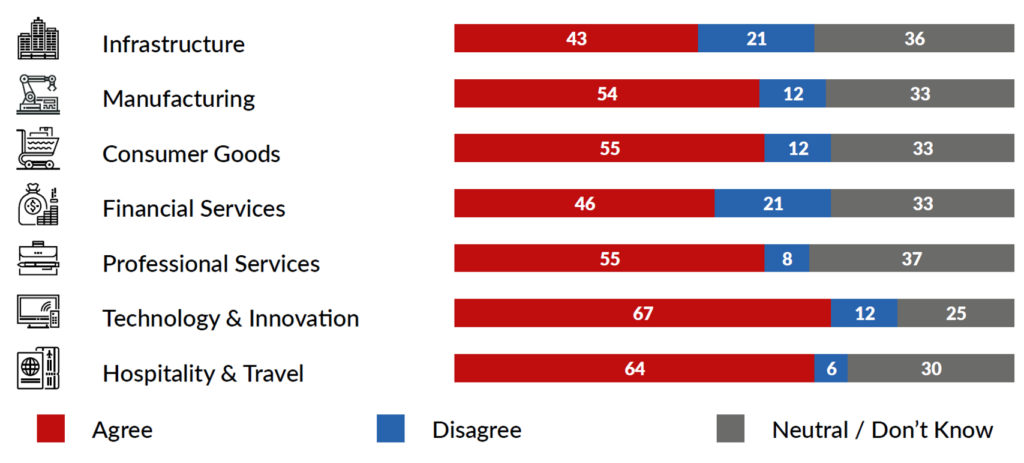

The Tricor Group business insights survey, COVID-19 Business Sentiment & Resilience Barometer report, done in partnership with Yougov, revealed that businesses are being negatively impact by COVID-19 to the point where businesses are struggling to adapt, are feeling inadequately prepared to deal with the crisis, and are concerned about the future growth of their business.

Figure 2: COVID-19 and its impact on future of business

concerned about the future of my business.

Source: COVID-19 Business Sentiment & Resilience Barometer report, Tricor 2020

Nearly 50% report that they will be forced to restructure business operations to stay afloat if the situation worsens.

Other key findings from the report include:

- 1 out of 2 executives agree that their business has been impacted by the current public health situation and are concerned about the future of their business.

- 43% of executives report that if the situation gets worse, they will need to consider restructuring operations.

- Less than 1 in 3 executives are confident they have well-equipped crisis management teams capable of handling the situation.

- 43% of the executives agree that COVID-19 has heightened their awareness of business continuity risks and has increased their need for third-party, consulting and outsourcing support.

- 46% of the executives are actively looking for ways to streamline business functions through cost reductions and operational efficiency.

- Nearly half of the executives cite cost reduction as a key strategic focus to help navigate business uncertainty resulting from the acute reliance on Mainland China.

Yong added: “As business leaders, we cannot always control the situation, but we can control how we react to it, particularly when it comes to dealing with disruptions to operations.”

Timothy Ho, CFO program leader at Deloitte Southeast Asia agreed and added: "2019 was seen as the year of uncertainty; however, the events this year have so far only deepened the level of uncertainty. In the midst of these uncertainties, risks needs to still be managed. CFOs are faced with increased government regulatory scrutiny and pressure on the compliance front. With digital transformation, CFOs need to be mindful of the risks associated with technological investments, which include cyber risk,” he suggested.

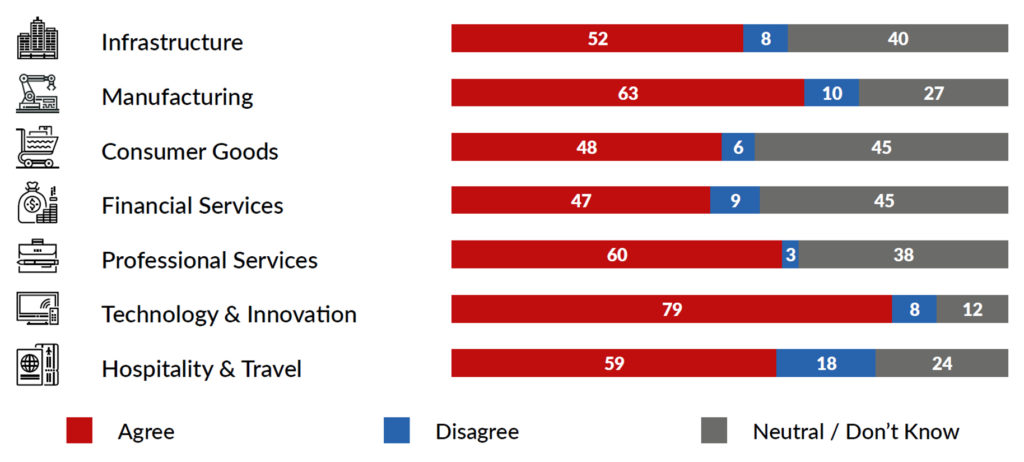

Figure 3: Response to COVID-19 by streamlining business functions through cost reductions, operational efficiencies

Survey: I am actively looking for ways to streamline business functions through cost

reductions, operational efficiency.

Source: COVID-19 Business Sentiment & Resilience Barometer report, Tricor 2020

To achieve business resiliency, top priorities for businesses include:

- De-risking and diversifying supply chains,

- Rebalancing market interdependencies,

- Restructuring business operations to reduce costs and

- Mitigating operational risk exposures through outsourcing and offshoring.

Gary Tok, Tricor Group Chief Commercial Officer said: “Amidst the COVID-19 outbreak, organisations in Asia Pacific are focusing on becoming more resilient by restructuring, diversifying and automating operations.”

Deloitte's Ho offered the following advice:

- Firstly, in today’s increasingly digital world, digital transformation is a top priority. Finance functions have to transform to drive greater automation, become more agile and leverage data and analytics to bring greater insight.

- Secondly, there is a global talent crunch. This means that there is a limited talent pool, especially people that possess the new competencies and skillsets (for example data science and analytics) that can align with the strategy to take the business forward into the digital future.

- Another concern is driven by the economic outlook for the year, which currently looks to be modest at best. There is a risk of a global pandemic that threatens to slow the economies in the region. Will the trade war between the US and China abate? These uncertainties present an opportunity for CFOs to step up and be more responsive in supporting the business in analyzing impact of supply chain disruptions, profitability of business segments across products or geographies, investment decisions and capital needs.