Kroll's latest Global Fraud and Risk Report 2021/22 reveals that organisations around the world are dealing with the rising costs associated with investigating allegations of serious misconduct.

Up to 82% of respondents said their organisations had been significantly impacted by fraud, corruption, illicit activity, money laundering or other serious misconduct.

Source: Kroll 2022

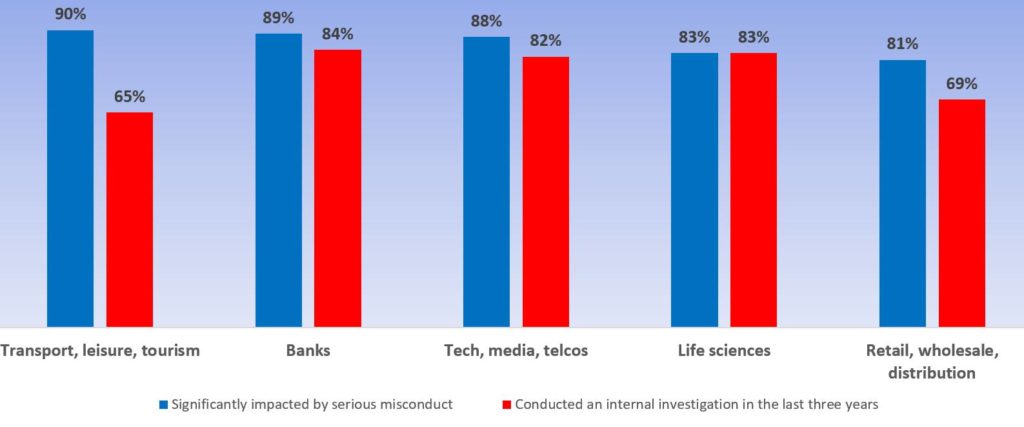

While 90% of respondents in the transport, leisure and tourism sector reported their organisation had been significantly impacted by serious misconduct, only 65% of organisations in this sector had conducted an internal investigation in the last three years.

Of all sectors surveyed, only the extractives sector reported a lower incidence of internal investigations (64%), with 75% of respondents reporting significant impacts from serious misconduct.

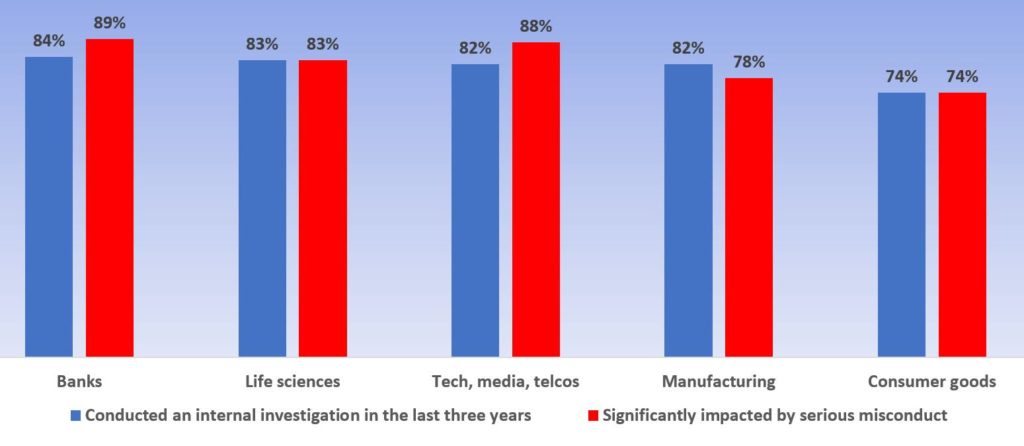

The report noted that the sectors most likely to have conducted an internal investigation

The survey reveals that 98% of organisations that had conducted an internal investigation recruited the help of external firms to assist, with the most called-upon advisors being computer forensics/eDiscovery firms (55%), followed by investigations firms (47%).

Despite advancements in technology and data analytics, 79% of respondents said the cost of investigations had increased over the past three years. Organisations with the highest turnover found themselves the most susceptible to rising costs, perhaps partly due to the growing complexity of global operations. About 49% of organisations surveyed with a turnover of more than US$15 billion (bn) felt the cost of internal investigations had “increased significantly,” almost double that of the global average (26%).

In China, 81% of respondents said the cost of relevant investigations had increased. Kroll’s research also shows the extent to which organisations believe that some firms offering investigative services are failing to deliver true value. Document review and eDiscovery services were identified as being the most expensive relative to their value by 29% of respondents, followed closely by computer forensics (24%).

This suggests that some external providers are not leveraging the most up-to-date tools and technology to efficiently find relevant information - the “smoking gun” email or transaction or significant anomalies – in massive volumes of structured and unstructured data.

Violet Ho, senior managing director and head of Greater China, Forensic Investigations and Intelligence, Kroll, commented that it is heartening to see so many organisations embracing data analytics as a powerful defence against bribery and corruption.

She added that organisations require the ability to carefully calibrate their analytics based on a deep understanding of their business and corresponding risk profile, as well as the expertise to interrogate and verify results correctly.

"Only with such a sophisticated approach can organisations bridge the divide between the C-suite, regional business practices, and third parties to effectively combat the risk of bribery and corruption,” she concluded.