A Gartner survey says supply chain organisations that enable customers to get their own jobs done are twice as likely to receive repurchase orders compared with peers that focus merely on customer satisfaction or ease.

The survey also found that customer enablement is only being emphasised by 23% of supply chain organisations today, but the strategy will become the norm within five years.

Gartner surveyed 650 supply chain leaders across geography and industry from August to October 2022 to provide a preview of supply chain strategic plans. In five years, 80% to 90% of all supply chains plan to adopt the key components of these strategies across four areas, including commercial innovation, sustainability, real-time execution and human-centric work design.

“The survey data showed that high-performing supply chain organisations are capturing competitive advantage and have capabilities at operational rates often twice as high compared to their lower-performing peers,” said Jennifer Loveland, senior director analyst with Gartner’s Supply Chain practice.

“These high-performing teams have also succeeded in retaining the respect of the C-Suite; 72% are viewed as strategic partners at a time when the perception of supply chain management’s importance has declined back to pre-pandemic levels at most organisations.”

Jennifer Loveland

Gartner identified high-performing supply chain organisations by rating their ability to exceed expectations on eight distinct measures over the past 12 months, including customer experience, stakeholder expectations and business performance, among other categories.

Loveland highlighted the divergence in how leading supply chain organisations approach commercial innovation strategies as one key example of the many best practices that high-performing supply chains do today that all supply chains must adapt to keep pace with peers in the next three-to-five years.

“Commercial innovation requires that there is no one-size-fits-all customer experience across the supply chain and no one-size-fits-every interaction for a specific customer,” said Loveland.

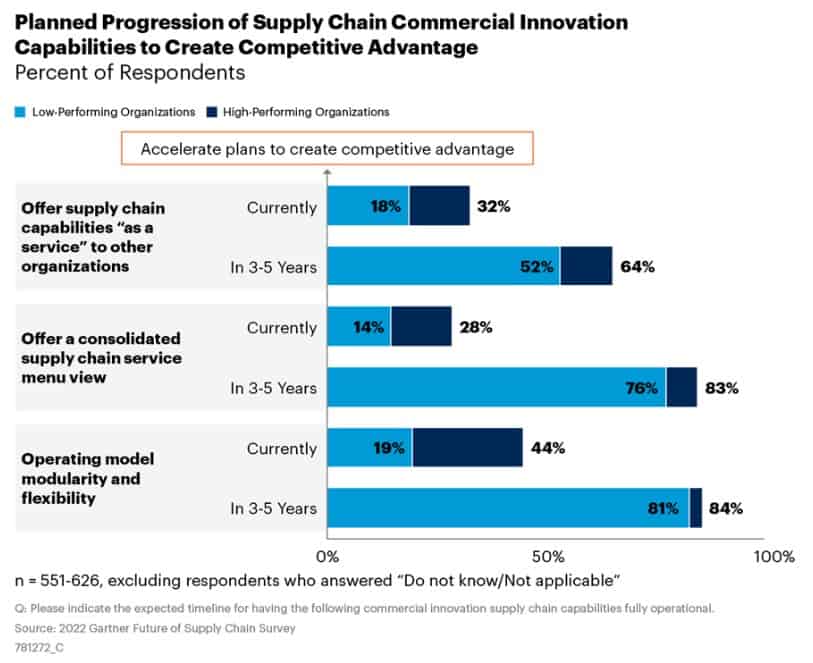

Traditionally, supply chain leaders think of high, medium, or low-value product or customer segmentations as the primary way to differentiate supply chain service; enablement takes this further by looking at supply chain choices beyond cost, lead time and availability and differentiating experience order-to-order. The specific strategies to achieve this are being enacted at high-performing organisations at significantly higher rates today compared with their low-performing peers. These strategies will become mainstream approaches within three-to-five years (See Figure 1).

Figure 1: Planned progression of supply chain commercial innovation capabilities

Supply chain organisations perceive the challenges with reinventing their commercial innovation strategies similarly, despite their differing performance levels. Both high and low-performing groups pointed to operational challenges related to providing a differentiated supply chain experience and a lack of funding to pursue opportunities as the top obstacles to success.

“All organisations can start now to build a service menu that captures the current options available where customers interact with their supply chain,” said Loveland. “Rapid innovation to expand that service menu captures an earlier mover advantage, while ongoing innovation in specific categories such as supply chain as a service (SCaaS) offer opportunities for advantage even beyond five years.”

To identify areas of cost improvement and gain more funding, supply chain organisations across the board must emphasise cost transparency. A “cost-to-serve” model can help align supply chain costs to service choices, rather than functions, which provides better transparency and increases the chances of funding new commercial innovation strategies.