The global transformation of banking and payments has only accelerated over the past few years, and between web trends and a global pandemic, the industry has seen disruption from all angles. Consumers are digitally connected in almost all facets of their lives — and it’s evident they expect the same from their banks and payment experiences, with consumers overwhelmingly expressing a preference for digital offerings from their financial institutions.

The Great Payments Disruption by Entrust highlights how consumer banking is about digital interactions first, and that banks must create that digital experience with security at its foundation.

Jenn Markey, vice president of product marketing at Entrust, says the study found both an overwhelming preference for online banking and significant concern about fraud – in fact, more than two-thirds of consumers in our survey changed their bank after receiving a fraud or privacy alert.

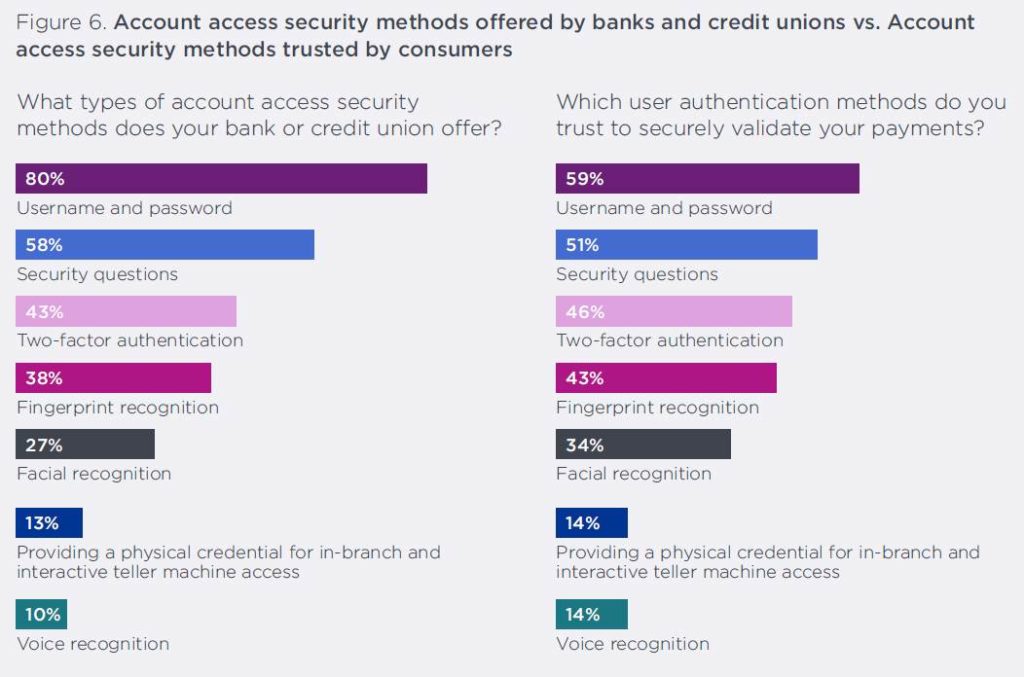

“It’s clear that financial institutions must meld rich digital experiences with proven security measures such as biometric security solutions to increase consumer trust and loyalty,” she continued.

Preferences when transacting online

Angus McDougall, regional vice president, Asia Pacific & Japan, Entrust, reflected on the survey adding that consumers are eager for digital banking experiences, but that does not mean they are willing to compromise on security.

Ninety-two per cent of survey respondents from the APAC region said they were concerned about the potential of banking or credit fraud as both become more digital.

There are good reasons for their concerns as many of these consumers have experienced fraud themselves: Nearly half (42%) of all respondents were notified of a personal banking or credit fraud in the past 12 months.

Given the major concerns that consumers expressed about fraud, banks need to strengthen their security posture with high-quality security tools to help reduce the frequency and severity of data breaches.

Banks should consider a security portfolio built on trusted identities, data and payments. For example, banks can ensure sensitive customer data is protected by using tactics like tokenization and encryption.

Instead of sharing the credit card number directly, banks can provide an encrypted token for each transaction. Even if there is a data breach, the customer’s payment information is unreadable and worthless to hackers.

“We have seen some banks in Asia leverage the use of mobile banking apps to authenticate customers, authorise transactions and send alerts to customers as part of efforts to stay ahead of security lapses. Others have also turned to the use of biometric authentication methods, in addition to passwords and OTPs, as a means of authentication,” he continued.

While customers don’t need to know the mechanics of the security technology of the banks, banks should still provide them with ongoing education about how the institution protects their accounts and how customers need to take precautions to protect themselves.

How are banks balancing this need for greater security versus more prevalent access for customers versus evolving regulations on privacy and data protection?

McDougall says consumers have high expectations for their banking institutions. They want to know that their identities and their accounts are secure, but they do not want to be inconvenienced with arduous security hoops and complex authentication requirements.

It’s key that while banks implement security measures, they must keep doing so in a way that doesn’t bring in more friction than a consumer is willing to deal with. A secure model does not have to deliver a poor user experience, and in fact – advanced security portfolios designed with the customer in mind can help banks keep their customer base secure and happy for years to come.

Tactics like passwordless access, device reputation management, transaction verification and adaptive authentication can help fight fraud without disrupting the consumer experience. These solutions both validate users and devices, while also proactively detecting and alerting banks to fraudulent patterns for quick remediation.

Banks should also work together with the relevant government bodies and regulators to ensure a well-rounded approach to security measures. For example, in the wake of the recent OCBC SMS phishing scam in Singapore, industry stakeholders have been working towards an ecosystem approach to strengthening security defences – which spans government ministries, banks and telecommunication players alike.

Challenges for banks in Asia three years into the pandemic

Zhi-Ying Barry, senior analyst with Forrester said with tightening net interest margins, banks across Asia-Pacific are feeling the pressure of sustaining profits while keeping costs low.

Many banks have accelerated technology and digital initiatives during the pandemic, such as investing in automation projects, as well as digital sales and servicing to drive operational efficiency, improve customer experience and reduce costs.

“But banks still struggle to keep up with increasing customer expectations and demands, particularly when it comes to anticipating their needs, serving customers in their moments of need whenever and wherever they are,” she added.

Have the industry responses in terms of new channels been accepted by customers – both consumers and corporate?

“We’ve seen the proliferation of digital payments over the pandemic, which was particularly pronounced with the older age groups. Digital wallet adoption has also increased. For businesses, many also started to use digital channels to apply for government grants and subsidies, as well as for loans and various lines of credit,” said Barry.

Asked for an indication of IT investment strategies in the coming years, Forrester’s Barry is confident that financial services firms will be doubling down on investments in digital platforms, automation, and cloud migration to deliver compelling experiences.

Key points of study

Omnichannel touchpoints are increasingly important in digital banking: 88% of respondents from Singapore said they prefer to do their banking online in some form – clear evidence that digital banking is the new norm.

However, it is still essential to provide a variety of digital options, as 65% said they prefer using the app from their bank, while 23% prefer their desktop web browser. Some people do still prefer in-person banking, such as at a branch (8%) or at an interactive teller machine (3%). This is aligned with global trends, and it is essential for banks to offer omnichannel, digital-first solutions to resonate with today’s consumers.

There is widespread interest in the digital banking atmosphere, with 69% of respondents from Singapore saying they would consider using a branchless online banking service for their banking.

Customers are security-conscious and lack of security can have damaging consequences: 98% of respondents from Singapore said they were concerned about the potential of banking or credit fraud as banking and credit become more digital.

Many respondents had personal experience with these fraud risks, with 33% saying they have received notification of a personal banking or credit fraud in the past 12 months. These incidents clearly damage customer loyalty, as 65% of respondents notified of fraud changed their bank as a result.