For decades businesses like banks have been amassing piles of data about their customers: their assets, their investment behaviour, etc. Yet, only a few have harnessed this wealth of insight to create deep and mutually beneficial symbiotic relationships.

Tech firms like Google, Alibaba, Facebook and Amazon, by virtue of their willingness to experiment (and fail several times) have proven that it is possible to innovate and create value using a data-driven approach.

In the UK, Monzo Bank famously found ways to save customers money by looking at spending patterns. This strategy helped them gain customers through word-of-mouth referrals and cross-sell financial products at the same time.

Indonesia’s Bank Mandiri is also taking a data-driven approach towards protecting its customer base, growing as a business, and proving itself a valuable partner to the government in times of need – as in the COVID-19 case.

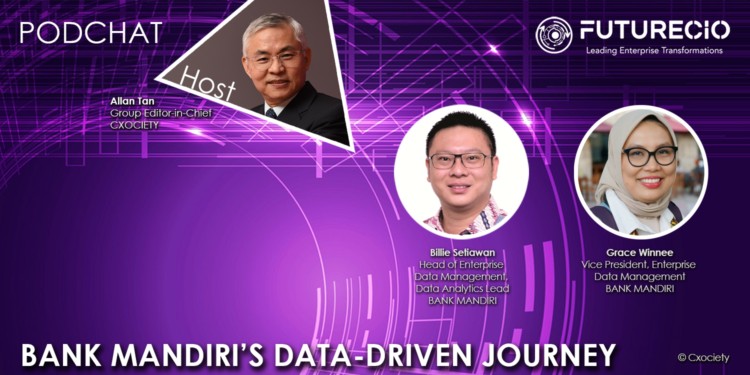

FutureCIO spoke to Billie Setiawan, head of Enterprise Data Management, Data Analytics Lead; and Grace Winnee, vice president, Enterprise Data Management, at Bank Mandiri to describe how they are turning the data on banking customers into a bankable business as well as for social good.

Why data is important to banks

Setiawan remarked that banks in Indonesia are evolving in terms of how they use data. They are using data to drive decision-making.

Bank Mandiri is taking this data-driven strategy further through the Enterprise Data Management (EDM) Group – a team whose primary purpose is to integrate data from “all the different systems in the bank into a single warehouse."

Setiawan explained that the bank wanted to have a single source of truth to ensure that everyone in the bank had the same understanding of the data, use the same data and understand the same definitions.

“We also wanted to holistically understand our customers; what kind of products they have, their profiles, how they behave, if the customer has a stronger relationship with us,” he added.

Implementation challenges

According to Setiawan one of the early challenges that group faced in the lead up to the creation of a data-driven culture was the process of gathering of all data sources into a single platform. “We then needed to standardize data to ensure that the definition and the understanding of each of the data in the bank is the same, between us and other groups,” he added.

The third challenge involved getting requirements on how the data is published, and to ensure that reports and dashboards that drew from the data were readable and understood across all the different groups, including management.

“We need to make sure that the people came back to the dashboards instead of creating their own reports. This was management and employees in the branches have the same view and understanding of each information,” he explained.

Bank Mandiri’s data-driven culture is underpinned by three pillars: data, information and insight.

Winnee emphasized the importance of a single source of truth as the foundation of all decision-making. The strategy is to not allow for individuals within the organisation to create their own version of the data which risks opening opportunities for dispute.

Reskilling for the future

According to Winnie, Bank Mandiri’s digital journey started as early as 2018 with the building of Mandiri Online – the bank’s online banking platform. The loan processing system was one of the first to go digital leveraging the bank’s e-commerce business.

She sees digital initiatives as becoming more important for banks as more people adopt a digital lifestyle centred around their use of mobile devices. In line with the trend, she expects the bank’s customers to go online instead of the physical branches.

“Many things will change in the future, two or three years down the road. Recognizing the trend, we are already reskilling our staff to create the competency needed for the future. These kinds of discussions have already started at our bank,” she affirmed.

Pivoting on analytics

One of the key conditions for a successful data-driven culture is influencing people’s understanding and of analytics in their decision-making process.

“We have activities and data analytics course programmes across the bank. Staff who are identified as being interested in data analytics are given the opportunity to shift their mindset from instinct to being driven by analytics. We prepare them to help understand the data,” said Setiawan.

He acknowledged the importance of management support in the execution of the bank’s data-driven strategy and expressed confidence in the role of data analytics in improving the bank’s future.

“We hope that in one or two years’ time, we will be in a much better position in terms of data analytics capability,” he beamed.

Click on the podchat player above to listen to the full dialogue with Bank Mandiri’s Billie Setiawan, and Grace Winnee.

During the podchat, they covered a number of issues including:

- Why did Bank Mandiri decide to adopt a data-first approach?

- How did Bank Mandiri implement and instil a data culture throughout the organisation?

- How does data serve the digital transformation initiative of Bank Mandiri?

- What have you learned from COVID-19 that you think will be helpful in future crisis?

- What are the opportunities for financial institutions to leverage data in the current day?