Process mining is using software to discover and map business processes to optimize and automate them—is an emerging market, growing at around 60-70% between 2019 and 2020 to reach a total market size of $320-$340 million.

Everest Group reports that the client base for process mining is rapidly expanding, driving revenue growth in the market. Even in the pandemic hit year, the client base experienced impressive growth at around 60%.

The researcher predicts adoption will accelerate across market segments, buoyed by increasing awareness of the technology, growing use of process mining as an enabler of digital transformation, and snowballing word of mouth of early adopters’ success stories.

It estimates that the process mining software market will triple between 2020 and 2022.

Adopting process mining

Process mining blends the power of data-based analysis techniques, such as data mining and machine learning, to help organizations discover the as-is process along with its variants and identify opportunities for optimization and automation.

Three categories

Classic process mining leverages specialized algorithms to analyze process-related information captured in event logs generated by enterprise systems such as ERP, CRM, and SCM to discover processes and generate process insights at a macro level.

Desktop process mining refers to the ability to capture and analyze keyboard, mouse, and potentially other system-level activities performed across multiple users involved in a process to virtually reconstruct the processes and provide process insights at a micro level.

Hybrid process mining refers to the ability to combine information from both event logs and user activities for a holistic view into as-is processes; it is carried out across both macro and micro levels.

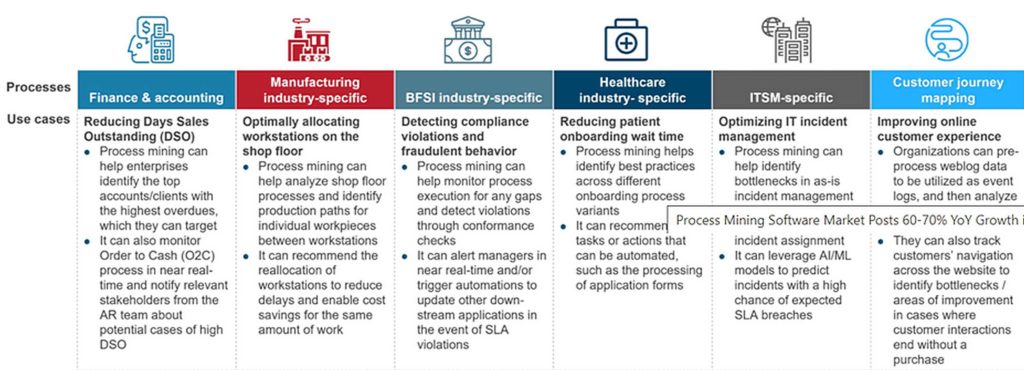

The need to optimize operations continues to be the most important factor driving process mining adoption.

Enhancing customer experience has emerged as the second key adoption driver because of the role process mining plays in mapping customer journeys to identify and address customer pain points.

Market highlights:

Currently, 86% of the revenue generated in the process mining market comes from software licenses, with most vendors offering cloud-based access.

Manufacturing; banking, financial services, and insurance (BFSI); and the healthcare industries are among the leading adopters of process mining solutions, accounting for more than 50% of the market share.

Celonis, Minit, Software AG and UiPath are the top providers in terms of process mining software revenue.