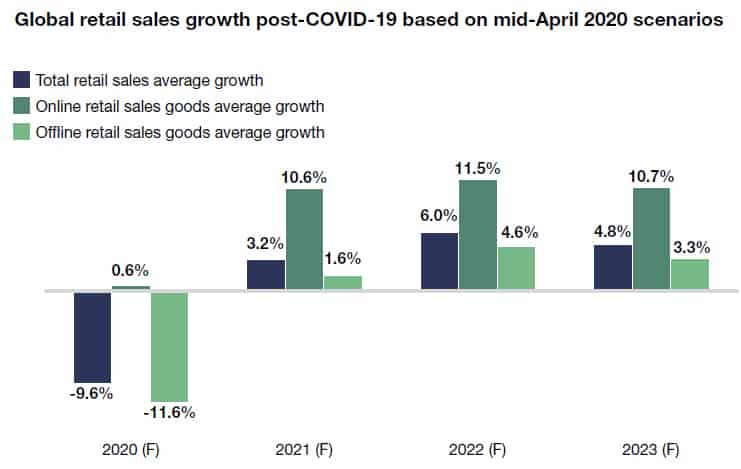

Forrester predicts that due to the coronavirus, global retail sales in 2020 will decline by an average of 9.6% globally, a loss of US$2.1 trillion. It also predicts that it will take four years for retailers to overtake pre-pandemic levels.

According to Forrester’s updated retail forecasts across North America, Asia, Europe, and Latin America, the impact of the coronavirus on retail sales will vary worldwide given the regional differences and considering that each country is at a different stage of the pandemic.

Not surprisingly, China is the worst-hit market in Asia-Pacific reporting US$192 billion loss in retail sales for the first two months of the year. Blame it on the coronavirus! What is surprising is that South Korea reported a 19% increase in online sales while offline sales was also up, albeit by only 3%. How did that happen? Forrester expects India and Japan to report losses as well given the 40-day lockdown (for India) and the postponement of the 2020 Summer Olympics in Tokyo.

Globally, retailers will continue to face growth constraints, with a lot of brick–and–mortar retailers predicting losses in 2020. Many will also assume that their growth in online sales will not be enough to offset the lost sales from store closures.

Despite significant losses in revenue, IDC said retailers will continue their digital transformation efforts, reserving capital for technology investments by reducing spending on store openings and remodels.

IDC predicts the ability to adapt responsively to product, workforce, partner, and operations needs will separate the winners and losers during the COVID-19 crisis.

KPMG’s chair of Global Retail Steering Group and head of Retail UK, Paul Martin noted that in the `red zone' markets where the virus is spreading, virtually every retail outlet, except grocery stores and pharmacies, is shut. Even those markets not under quarantine orders have seen a precarious drop off in physical footfall in retail outlets and malls.

While some retailers are seeing demand fall away and customers shift channels, others are facing unprecedented spikes in demand. “Grocery retailers, in particular, are dealing with significant out-of-stock situations on many key products as consumers hoover up supplies perceived to be essential. The ability to predict and manage demand has never been more important,” said Martin.

The losses in Asia Pacific will reach US$767 billion in 2020, dropping 10% from 2019. China is the most negatively affected country in the region, with $192 billion of retail sales lost in January and February of 2020 compared to the same period in 2019.

Jessie Qian, country sector head of consumer and retail at KPMG China, said the country’s experience shows how innovative companies might address these challenges.

“During the height of the outbreak there, grocery operators temporarily hired thousands of restaurant employees who were idle due to restaurant closure to help meet spikes in demand. Other companies have been moving employees around the organization to fill gaps and relieve overworked departments,” she added.

Retail technology investments will continue to reflect digital transformation efforts, as retailers reserve capital for technology investments by reducing spending on store openings and remodels. The ability to adapt responsively to product, workforce, partner, and operations needs will separate the winners and losers during the COVID-19 crisis.