Widespread inflation and increasing healthcare use are combined to drive projected increases in global healthcare benefit costs to their highest level in nearly 15 years.

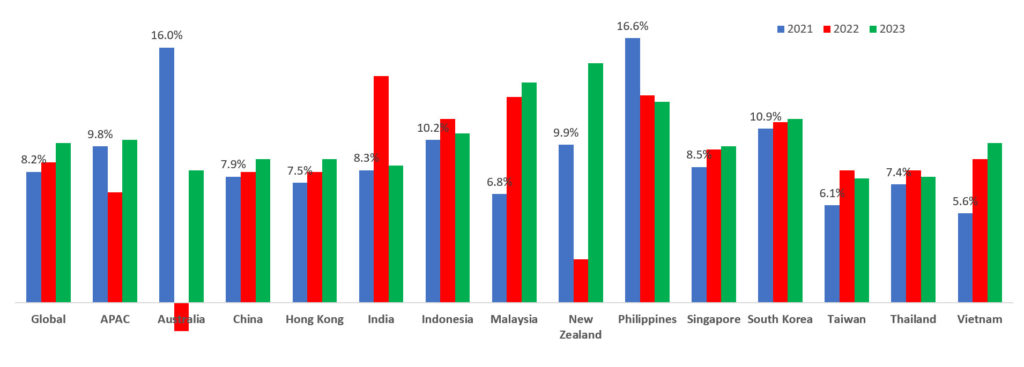

The 2023 Global Medical Trends Survey reveals that the healthcare benefit cost trend in APAC rose from an average of 6.2% in 2020 to 9.8% in 2021, then declined to 6.9% in 2022. For next year, it is projected that cost will rebound to 10.2% in 2023.

A WTW survey of global medical insurers noted that 73% of insurers in Asia Pacific (APAC) anticipate higher or significantly higher increases over the next three years.

The survey also disclosed sizeable variations in cost trend increases by markets. With various countries reopening up their borders after the lifting of COVID-19 restrictions this year, it is expected that healthcare utilisation and costs around the region will increase next year.

“Worldwide inflation and a rise in healthcare use in the wake of the pandemic are delivering a one-two punch on medical costs around the globe,” said Cedric Luah, head of health and benefits international, WTW.

“The bottom line is that these large increases are unsustainable. Employers and insurers will need to develop strategies and solutions to rein in costs to more manageable levels.”

The leading driver of medical costs

Insurers identified the leading driver of medical costs to be overuse of care (81%) due to medical professionals recommending too many services or overprescribing. Insured members’ poor health habits (58%) are the second leading driver.

The underuse of preventive services (46%) is also a significant cost driver and increased year-over-year due to, in part, the avoidance of medical care during the pandemic.

Most expensive medical conditions

Insurers in APAC identified cancer, cardiovascular and musculoskeletal as the top three conditions by cost, identical to last year’s findings. Cancer continues to be the leading condition in terms of incidence of claims and cost.

Mental health conditions such as anxiety and depression continue to take a toll on employees. Insurers expect mental and behaviour disorders to be among the top five fastest-growing conditions by the incidence of claims in this region in the next 18 months. Interestingly, insurers have also ranked treatments related to reproductive systems as one of the top five conditions that are affecting medical costs this year.

Revelation from pandemic

The pandemic has also highlighted health disparities among different employee groups, promoting employers to place a greater emphasis on diversity, equity and inclusion (DEI) in their healthcare strategy.

“Exclusions persist for conditions in areas related to DEI, a key priority and board-level issue in many organisations,” said Eva Liu, Asia and Australasia, WTW.

“These exclusions range from fertility treatment, HIV/AIDS, treatments related to menopause and other mental and behavioural health including but not limited to Autism, ADHD and so on. Employers should consider how they can bridge these coverage gaps and help deliver more equitable health outcomes across different employee groups.”

Eva Liu

“Healthcare affordability remains top of mind for insurers, employers and employees. As we move into next year, we see a challenging year for employers in trying to balance the convergence of rising medical trends, salary pressures and the need to continue to make progress on DE&I initiatives globally, all while dealing with potential recessionary markets,” she added.

Singapore’s rising medical cost inflation

Singapore’s core and headline inflation figures continue to rise with projected 2023 medical inflation roaring to 9.8%. As a medical tourism hub, Singapore being one of the first few Asia countries to lift the travel ban, experienced a large influx of overseas patients seeking previously deferred elective treatment.

The fast-ageing workforce coupled with a heavier chronic disease burden remained key contributors to the rise in healthcare costs. Other contributing factors include overuse of care by insured members, as well as overtreatment or overprescribing by medical practitioners.

Though not expecting to benefit from short-term results, organisations are now more open to preventive care and wellbeing programmes, adopting a more strategic and longer-term view to tame their medical cost increases with more employers requesting to integrate wellbeing as a core component of their healthcare benefit programmes.