Backdrop: During a Huawei media roundtable coinciding with the vendor’s Intelligent Finance Summit 2022 event, Ryan Ding, president of the Enterprise Business Group at Huawei gave a report card – on the company's progress during the pandemic in support of the financial services industry in Asia and around the world.

Specific to the financial services industry, he mentioned DBS and its pursuit of intelligent, intuitive, and invisible banking. By using AI and hyper-personalization, the DBS NAV Planner tool generates more than 30 million insights each month to help customers manage their money better.

He also called out China Merchants Bank for its mobile-first and super app strategy. With the super app, they launched over 2200 new functions in 2021.

And how ICBC (Industrial and Commercial Bank of China) has built a bank-wide, componentized, and configurable business and data capability centre. Now, 95% of new products can be launched in T+0 or T+1.

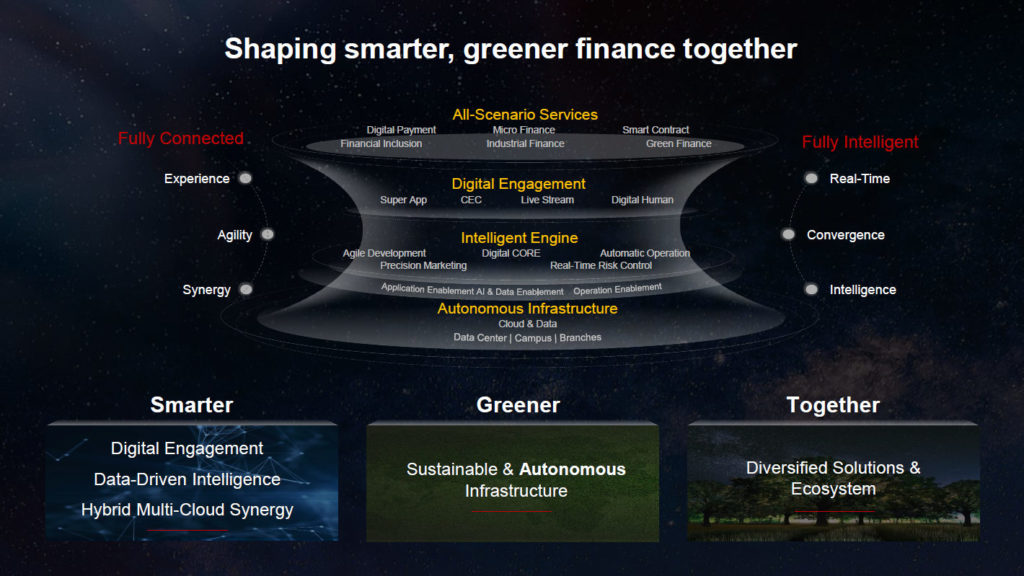

Ding spoke at length about Huawei’s approach to the financial services sector revolving around three strategies: to build smarter and more open hybrid multi-cloud architecture and data capabilities; to provide green and robotic infrastructure for business agility and sustainable development; and to create an open ecosystem that would allow Huawei to provide scenario-based solutions and build complete solutions with banks.

At the media briefing, Jason Cao, CEO of Huawei Digital Finance offered more details in support of Huawei's plans to further its efforts in the financial services sector.

What are some of the top challenges that banks in Asia Pacific face when it comes to greening their operations, and perhaps how is Huawei helping them in that aspect?

Jason Cao: For banks to provide financial services, they are actually a very large consumer of computing resources and computing power. To make them go digital, they need to consume a lot of digital resources and they need to consume a lot of data.

"Because we're a technology provider, we have to think from the perspective of technologies to resolve this issue, to help the bank reduce their carbon emission and safe energy, and so there are three directions we're focusing on."

Jason Cao

The first direction or innovation we should be focusing is on the power supply, for banks to go with cleaner energy, to use more PV (photovoltaic) or solar energy, and that is from the perspective of power supply to help the financial institutions to go clean.

The second aspect we're focusing on is power consumption. For banks to use a lot of equipment, we can apply technology to improve the efficiency of heat spreading so that the power used for the cooling system will be reduced.

And specifically, we have designed a cycle system, the recycling system for heat to be dispersed efficiently and smartly. The third aspect is power management, and this solution can address end-to-end problems. For example, Huawei’s M2RS management modules include a smart management module of the system that can detect when the peak period and non-peak period of the equipment used is for the bank.

Are you able to share any specific examples or case studies of how Huawei helps local banks, for example, OCBC or DBS, with all their green finance initiatives?

Jason Cao: For us, we have the power management as well as the power consumption modules or technologies embedded in our product suites, and many of our clients are already using them. Of course, compared with many existing solutions that have been used in the past, our solutions have very significant differences.

The first difference is in the performance. For the existing solutions, the performances are not so high, so you need to consume much more energy in order to achieve the same efficiency and the same result.

And secondly, these solutions are not smart enough and not able to produce flexible configurations as I have described before. From the technology perspective, we have four solutions or four measurements to help resolve the issues.

The first is the power supply. By transferring or transitioning from the traditional types of batteries to new types of batteries that we use, we can improve energy efficiency significantly. And secondly, we’re simplifying the energy structure for usage. And thirdly, we use AI algorithms to make the configuration smarter. And fourthly, we focus on operation management to provide an end-to-end smart solution.

With these four approaches or applications, the performances have been significantly improved in terms of reducing energy, and an added benefit is that you only need a small rack or a small cabinet. So space saving is also significant.

One of the key problems we have in reducing mainframe MIPS is the core system, and most of the work we're doing in the cloud right now is middleware extension to the core rather than core replacement. Is Huawei's strategy to lead to more core replacement or how do you see the relationship between the core and the cloud progressing over time?

Jason Cao: Undoubtedly the first point I want to mention is the open framework and going to the cloud. The second point is that each bank has its specific situations and specific strategies to deal with.

Some of the banks are conservative, and some of them are aggressive, they want to achieve it all in one go. And some of them will take steps and take the time.

And of course, the reasons are different. Some of them may be pressured by their business development speed and some of them will have to build in agility their operation.

And for those who don't really want to spend so much on reconstructing their applications, we have other solutions to help them save the cost. And then of course we will have to help the banks build their core technical capabilities, such as what you have mentioned, the cloud, the database, and the middleware.

How would Huawei deal with the compliance issues and requirements in each country?

Jason Cao: For Huawei to serve financial institutions, security and risk control is paramount. When it comes to businesses transitioning into the cloud, security is always very important. Besides our internal analysis of compliance requirements, we are also working with external partners to actively follow compliance guidelines in each country.

To us, security and reliability in our technology is the foremost important thing. And after that, we must be able to follow the compliance guidelines in each country by each financial institution. These are extremely important to us.

How do you see Huawei continue to make cloud infrastructure increasingly sustainable and ESG-compliant?

Jason Cao: Each technology – cloud, AI, edge computing – have unique features. Maybe to start, let me share with you a small case. If you use your mobile phone to carry out mobile banking, to run a mobile banking application, the network involved is very complicated, because the mobile phone itself is an edge computing device, and whenever you're connecting to the mobile banking application, the data goes through your mobile phone to the nearby cell station and perhaps going through the local Wi-Fi network up to the cloud. From the cloud, the Wi-Fi to the cloud, there is also a complex path.

If there is an issue with the service, say the customer clicks on a button in the application and there is no response, and you need to find out where the problem is. Is it the phone itself or is it the network that it is connecting to, or is it with the banking application?

To provide a better customer experience, you need to quickly identify where that problem is. So if you're using a traditional system, then you need to go through every segment on this journey to find where that problem is.

However, if we are taking an autonomous approach, we are basically looking at the signal transmission end to end and identifying the problem in one go and solving it in a fast manner. This is a classic example of using cloud plus edge computing plus AI combined.

With more and more business processes added together and getting complicated, we are gearing towards this direction, to have autonomous driving as an example, to make sure that problems can be quickly identified and resolved.