With the uncertain effects of COVID still persisting, you will have to balance your 2022 growth priorities while remaining prepared to respond to the pandemic.

There are four major trends across the financial services industry, and you should be aware of how these potential threats and/or growth opportunities will impact your firm.

Moving into 2022, make sure your new strategic plans address these major industry trends. It could be the difference between winning and losing.

The four major trends shaping the industry:

- New competitors are disrupting the market through technology innovation and distribution.

- Digital transformation remains elusive as leaders focus mostly on optimization.

- Firms see their proprietary data assets as a silver bullet to adapt to changing customer preferences.

- Evolving employee expectations and required skill sets are upending the traditional workforce models.

New competitors are disrupting the market through technology innovation and distribution

Seventy-seven per cent of FS leaders expect significant or substantial industry transformation over the next five years. But there’s already been a massive impact in the payments space.

The share of customers using two or more digital payment methods has increased from 38% in 2016 to 58% in 2020. And the largest applications – Alipay, WeChat, Apple Pay, Google Pay, and Amazon Pay – already have an estimated 3.2 billion combined users.

The disruption caused by fintechs and digital giants such as Amazon and Google etc. can be seen as a major threat or a major opportunity. Your firm should develop a position on fintechs.

Understand what they do and how they could be a potential threat. Weigh your options for engagement and then determine if partnering with them would benefit your firm.

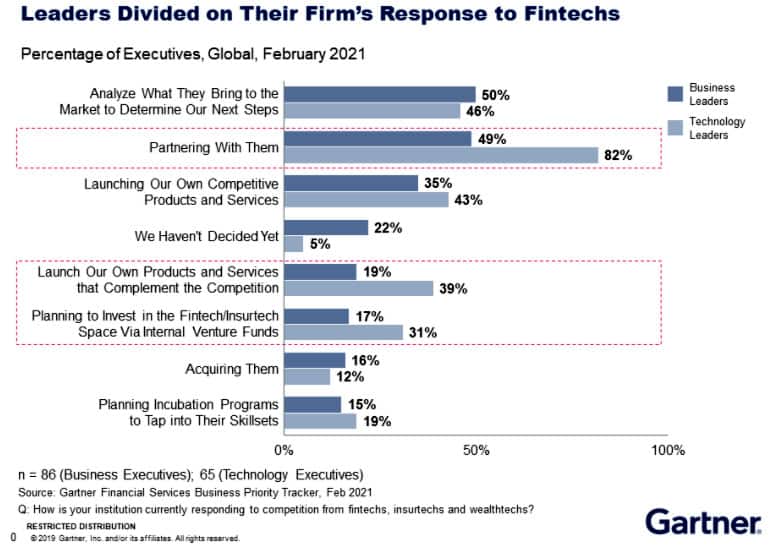

Here’s how business and technology leaders throughout the industry are responding to fintechs:

Digital transformation remains elusive as leaders focus mostly on optimization

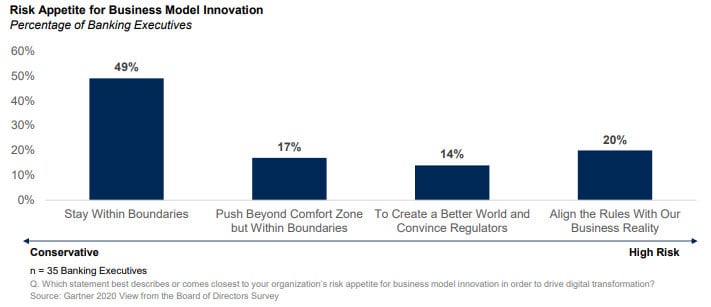

An increasing number of financial institutions are investing in artificial intelligence and open banking. But leaders are still very conservative with their approach to business model innovation.

But there’s a way to balance risks with innovation. Financial institutions using a learning approach are more than twice as likely to achieve progress toward business model innovation. This approach enables executives to discover the correct path to business model change.

A learning approach means exacting what it sounds like…trying many things at once and seeing what works. It means understanding your business objectives and working with cross-functional partners to build strategic technology plans. It means aligning with other leaders on specific metrics and benchmarking targets to know which technology initiatives are working and which are not. And it means networking for the duration of these initiatives, sharing best practices, pitfalls, and deciding when to go all-in, when to course-correct, or when to pull the plug. It means learning on the go.

Firms see their proprietary data assets as a silver bullet to adapt to changing customer preferences.

Banking customers are expected to increase their use of digital channels beyond the COVID pandemic. But digital customers are not the segment where banks are raking in cash. Rightfully so, leaders are investing heavily to improve the customer experience through better usage of data analytics.

Leading FIs are supporting digital customers’ financial empowerment. This means educating customers about their financial options, enabling them to take action, and reassuring them to make them feel better about the relationship.

But two key ingredients to this approach are tailored product and service recommendations and sensemaking sales tactics. Better usage of data and analytics will help firms provide more accurate recommendations and help frontline staff effectively educate customers about their options and next actions.

With the help of your sales, marketing, IT, and operations partners, examine what your firm can do to grow its capabilities by using data for deploying tailored marketing insights. What are your strengths, weaknesses, and where should you invest in 2022?

Evolving employee expectations and required skill sets are upending the traditional workforce models.

Nearly three-quarters of jobs had more than 40% of their required skills change between 2016 and 2019. Although technology is driving new skills needs, most new competencies are soft skills, not hard skills. Financial institutions need employees who can collaborate, innovate, adapt, and persevere through business disruption.

Moreover, 74% of FS employees have increased their work-from-home time since the start of COVID-19. And nearly 60% of FS employees will continue to work in a hybrid or remote environment. By 2022, more than two-thirds of cross-industry employees will consider flexible working arrangements to be a differentiator when selecting an employer.

In other words, your workforce models should take into account the preferences of your employees. Because that’s what your peers are doing.

What are your plans for in-person, hybrid, and remote work models in 2022? Do these plans align with your employees’ preferences? Have you engaged managers and employees about their preferred style of work?

And have you adopted new ways for employees to develop skills and collaborate within your future work model?

If not, you should take the time to understand the preferences of your workforce and align your future work strategy to meet those needs.

Conclusion

As you adopt new strategies moving into 2022, embed these industry trends into your firm’s plans if you haven’t already. And pull in your business partners to make sure you’ve exhausted all avenues on how you can turn these potential threats into growth opportunities.

First published on Gartner Blog Network