For decades supply chains were designed for cost and efficiency. As global commerce matures these networks also grew in complexity. The McKinsey Global Institute (MGI) estimates that since 2000 the value of intermediate goods traded globally has exceeded US$10 trillion annually.

Businesses that successfully implemented a lean, global model of manufacturing achieved improvements in indicators such as inventory levels, on-time-in-full deliveries, and shorter lead times, said the consultant.

These supply chains have also become more vulnerable to disruptions, as evidenced in the first quarter of 2020 as the COVID-19 outbreak exploded in China and spread around the world.

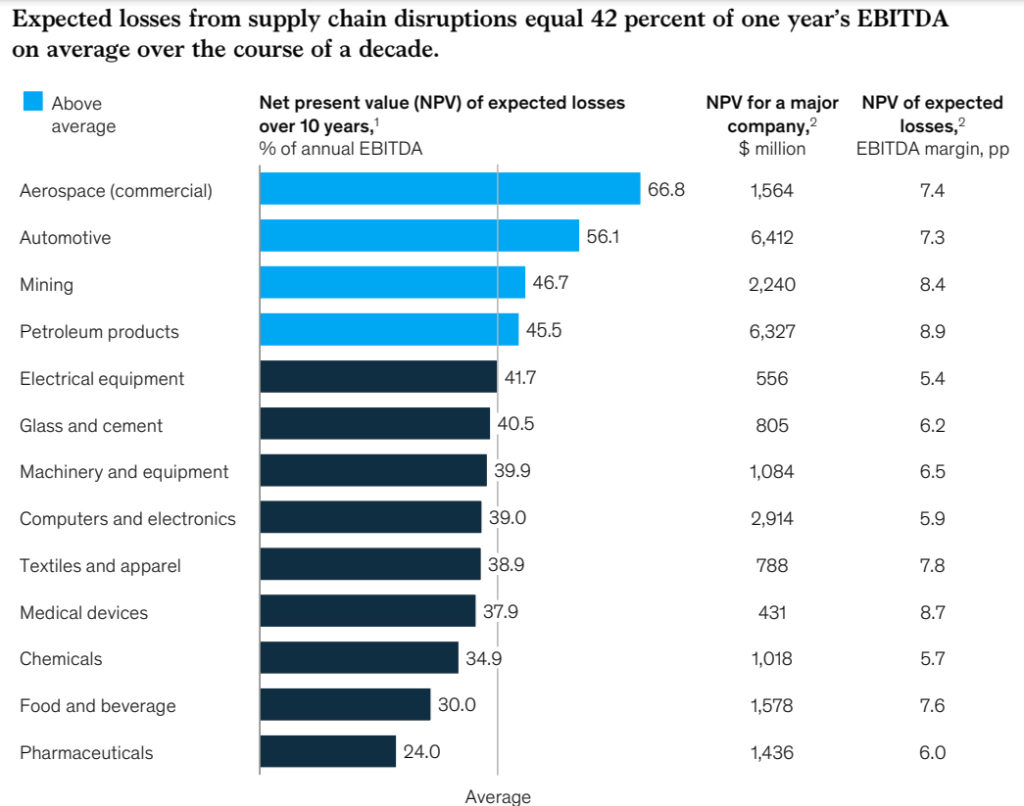

MGI estimates that supply chain disruptions can cost company as much as 42% of one year’s EBITDA in losses every decade.

shock (varies across industries). Amount is expressed as a share of one year’s revenue (i.e., it is not recurring over modeled 10-year period).

Calculated by aggregating cash value of expected shocks over a 10-year period based on averages of production-only and production and

distribution disruption scenarios multiplied by probability of event occurring for a given year. Expected cash impact is discounted based on each

industry’s weighted average cost of capital.

Based on weighted average revenue of top 25 companies by market cap in each industry.

Source: S&P Capital IQ; McKinsey Global Institute analysis

“Investing to minimize these losses can pay off over the long term.” McKinsey Global Institute

This expanding complexity of the supply chain has called into question the effectiveness of traditional solutions. Technology is seen as one such tool to aid in the calls for greater resilience.

Technology to aid in the drive for resilience

ABI Research called on supply chain leaders across all verticals to adopt a more advanced and inclusive approach to forecasting and adapting to a continually changing environment. One such outcome is the accelerated adoption of Transportation Management System (TMS).

TMS solutions enable greater visibility, efficiency, reliability, and flexibility of freight movement across modes, cargo types, and geographies.

“There is growing usage of open APIs and Software Development Kits (SDKs) to create customized solutions for different sized companies, verticals, and geographies as well as partners and co-opetition,” explained Susan Beardslee, principal analyst, Freight Transportation & Logistics.

ABI Research forecasts global TMS revenues are expected to nearly double from US$16 billion in 2020 to reach over US$31 billion in 2025.

Beardslee added that “adoption triggers include capacity constraints, which are growing ever tighter (including driver shortages back to 2018 levels) and pushing up costs toward the double-digits. Beyond that, consumers and businesses continue to push for more granularity in answering, “where’s my stuff?” with an ETE, real-time response.”

Synergistic technologies like predictive analytics, automation, real-time tracking, machine learning, Proven ROI is the primary argument for TMS adoption. For instance, artificial intelligence (AI) and advanced analytics can reliably interpret data from many complex indicators and execute more insightful and connected strategies.

AI, and blockchain will continue to evolve for greater flexibility, improved customer support, and enhanced forecasting capabilities.