According to IDC's survey presentation Accelerated Pace of WorkSpace Transformation in APeJ, WorkSpace transformation initiatives will see different pace and extent of adoption across Asia/Pacific as organisations strive for different strategic IT objectives.

Digital transformation initiatives, catalysed by the COVID-19 pandemic, have impacted organisational usage and spending on imaging, print and document solutions. These behavioural differences have allowed IDC to group survey responses that were then clustered into four unique groups: Digital Leader (44.9%), Digital Emergent (22.2%), Digital Distressed (30.3%) and Digital Laggard (2.3%).

Figure 1: Asia/Pacific* Organisation’s Status in Workspace Transformation

These clusters differ in degree of transformation, timeline and strategic objectives. Moreover, the clusters also differ in current and future usage of print / document solutions, and which service provider they prefer to achieve their desired state of transformation.

Of interest were Malaysia, Singapore, and Thailand having majority of respondents classified as Digital Leader (68.5%), and India having the most Digital Emergent respondents (27.4%). These countries outpaced the digitally mature Australia – Digital Leader (55.2%), Digital Emergent (15.2%), Digital Distressed (23.2%), and Digital Laggard (6.4%).

These findings speak to the impact of a strong digital mandate from the government, and the impact of digital legacy has on digital transformation.

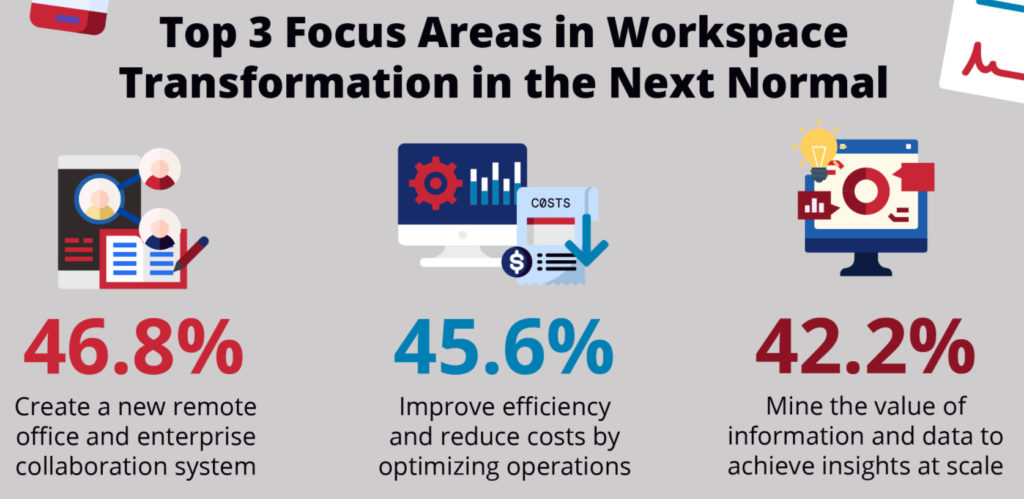

These differences will in turn reflect how each cluster will address the top 3 priorities of future transformation initiatives brought on by COVID-19: creating a new remote office & enterprise collaboration system (46.8%), improving efficiency and reducing costs by optimising operations (45.6%) and mining the value of information and data to achieve insights at scale (42.2%). Organisations must align their go-to-market strategy (Core Print, Hybrid Documents, Transformation) to help them achieve their desired future WorkSpace.

“Service providers must ensure their go-to-market approach speaks to the business focus of the clusters while adapting their product, channel, and vertical focus to capitalise on the rapidly evolving landscape,” says Kenneth Tham, senior market analyst for Imaging, Print and Document Solutions at IDC Asia/Pacific.

Other highlights

- 57.3% of Digital Emergent respondents were from non-MNC organisations indicating grassroots transformation and digital determination.

- Government agencies contributed 14.0% of respondents in the Digital Emergent cluster which bucks the trend of governments being slow to adopt technology to transform the WorkSpace.

- Digital Distressed organisations were stuck between remaining analogue or going digital fuel by limited budgets and lack of strategic initiative.

- Digital Laggard organisations typically avoiding print/document software but were receptive to cloud-based solutions which allowed improve access and organisation of hard / softcopy.