Across many parts of developing Asia, COVID-19 has been harsh to consumers and businesses. Extended restrictions on mobility, some lasting months, has forced businesses to rethink business models. In some cases, this has accelerated a trend occurring in the US and European markets – bank branch closures in the face of uncertainty and changing customer buying patterns.

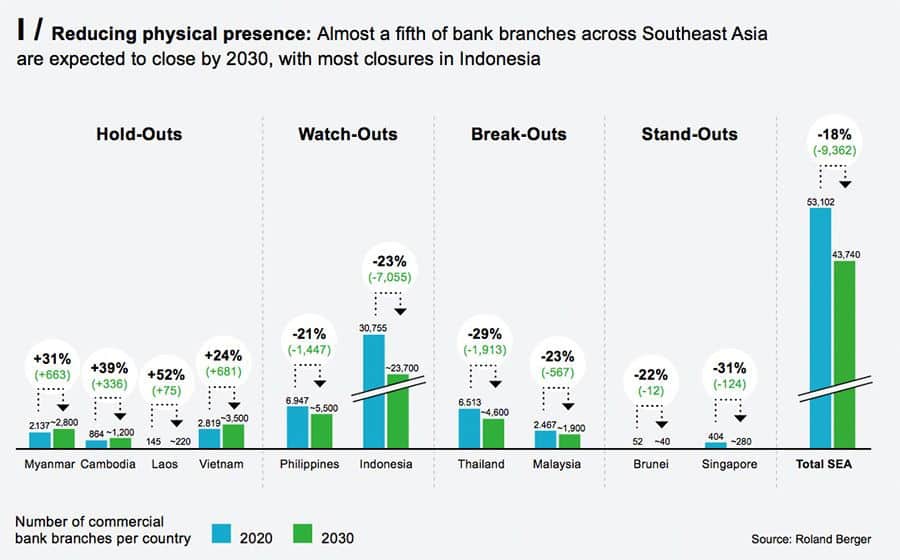

While the pandemic is one factor for the closure of bank branches in Asia, the relative immaturity of the banking industry, particularly in Southeast Asia, Roland Berger forecasts branch closures to continue to account for only 18% of current physical banking presence. The firm expects 11,000 branch closures leading up to 2030.

In a PodChats interview with Lito Villanueva, executive vice president and chief innovation and inclusion officer at RCBC, he expressed optimism about the future of banking, despite acknowledging the closure of some of its branches during the pandemic.

McKinsey agrees that relative to other markets, “banks in Southeast Asia are likely to emerge from the current crisis in comparatively stronger positions, due to higher rates providing more margins on deposits, more demand for sustainability loans and high digitisation momentum created by new customer habits formed during the pandemic,” said Guillaume de Gantès, senior partner at McKinsey.

FutureCIO spoke to Karen Clarke, managing director of APAC, Anaplan, for her take on factors impacting the banking industry.

Has COVID-19 diminished the value of bank branches in favour of online and mobile?

Karen Clarke: With the global pandemic accelerating the migration from physical to digital baking channels, this shift has taken a toll on brick-and-mortar bank branches across Asia Pacific. Banking services such as money transfers, loan applications and payments can now be accessed online, giving consumers fewer reasons to visit physical bank branches.

A recent Boston Consulting Group report on the state of banking in Southeast Asia even expects one in four customers to visit physical branches less frequently or stop visiting altogether even when the crisis is resolved. The convenience that comes with new digital banking services, coupled with safe distancing restrictions and consumers’ fear of going out, has put bank branches at risk.

That said, bank branches still play a crucial role in customer engagement, building trust and credibility, and supporting the transition to digital channels.

While some banks have weathered the financial crisis and managed to keep their branches open, the sector continues to face major strategic challenges. These come in the form of increased regulation, competition from new entrants, resource optimization programs amidst the rationalization of branch networks, and the rise of disruptive digital technologies.

With banks under pressure to cut costs and improve capital allocation, the need has never been greater for an enterprise-wide planning strategy that encompasses budgeting and forecasting.

Do you know of any bank in Asia that has successfully innovated the branch while transforming its banking business?

Karen Clarke: The onset of digitalization in the banking space has led large retail banks to re-examine their strategies—from resizing and repurposing physical branches to moving product offerings from physical to digital to optimizing capacity across channels.

As more digital banks, neo banks and super app players spring up across Asia Pacific, traditional banks facing increasingly stiff competition are rushing to innovate and level the playing field.

For example, one of the largest banks in the region revamped its branches to cater to consumers and their changing needs in the COVID-19 era. The new branch offers faster, socially distanced, and more personalized services, including 24/7 self-service options with face-to-face assistance.

This means that consumers can access complex transactions outside of traditional banking hours and enjoy enhanced personalized financial planning advisory.

Additionally, the bank has accelerated its adoption of a broad set of digital capabilities and their customer volume using these digital tools has gone up 30 to 40% in some areas and 300 to 400% in others. Services offer support as a day-to-day partner to consumers searching for new homes, car services, holiday bookings, utility bill management or even online shopping.

To stay ahead of shifting consumer preferences—whether it’s customer service or the sale of products—banks must adopt a digital-first strategy, accelerate efficiencies, and reduce cost by embracing digital tools and shifting to digital channels.

What applications (use cases) in the bank branch do you see being transformed (not necessarily going away)?

Karen Clarke: There is no blueprint to transforming branch networks. Rather, it is finding the sweet spot between physical and digital services across bank services and functions.

Bank branches are expected to see a continued change in this hyper-digital era, ultimately impacting in-branch resources toward contact centres and digital teams in the coming years.

For example, banking contact centres find themselves managing increasingly complex types of issues, shifting from information calls to addressing more complex sales and purchase-related activities.

Despite the move to digital servicing, the need for human interaction, like that found with a trusted financial advisor, is just as important as the digital banking tools being deployed in the consumer banking journey. Consumers are at the core of banks, and ‘customer experience’ will always be a key priority.

For banks to remain nimble and keep pace with ever-changing customer preferences, they must consider leveraging tools like scenario analysis and intelligent forecasting to anticipate future challenges, forecast based on an agreed set of assumptions, and establish the required course of action to be taken for all potential scenarios.

And with the advent of emerging technologies like artificial intelligence and machine learning, banks can better serve consumers and elevate their experience with facial recognition and anomaly detection.

This way, banks can pivot and adjust their strategies according to new events and changes, helping them stay agile and ride the waves of adversity confidently while remaining customer-focused.

What needs to change at the bank for this bank branch transformation to be realized?

Karen Clarke: As the digital transformation journey of the bank branch continues, reducing costs and improving customer experiences should be top priorities, but how each bank approaches its specific journey will likely be dependent on certain considerations.

Some banks might decide to downsize or differentiate their branches to meet the evolving customer demand across the networks. For instance, we have seen that HSBC has decreased the size of its branch network by 60% during the last twenty years and has decided to repurpose its remaining branches into four different formats: full service, cash service, digital service and pop-up branches.

Other banks instead might merge branch networks to optimize branch location strategy, drive network synergies, and eliminate redundancies. For instance, in France, the merger between Societe Generale and Credit du Nord branch networks is set to lead to a 30% reduction of the size of the combined retail network in the next five years.

Ultimately, banks that can drive successful transformations need to model out different scenarios for disruptions and uncertainties, such as exchange rates fluctuations or trade barriers that arise from global events.

Which technologies will facilitate this bank branch transformation?

Karen Clarke: There is no one-size-fits-all technological solution for branch networks. Finding the right balance between physical and digital services will require transformation across the organization.

For instance, the likely movement of in-branch resources toward contact centres and digital teams: this shift will require banks to adjust their workforce models accordingly. Planning for the future of the workforce will be a key success factor of the branch network transformation.

Additionally, embracing artificial intelligence and machine learning will enable banks to create technology task forces to serve their retail customers, such as BBVA’s AI Factory, the bank’s global development centre that brings together a cross-disciplinary team of data scientists, engineers, and representatives from other business areas to power artificial intelligence capabilities for customer solutions.

Nonetheless, even when empowered by artificial intelligence, branches are not going to disappear and will remain the place to deal with specific operations where customers need human interaction with a financial advisor they trust.

Whether it’s redesigning a branch, revisiting location strategy, or adapting distribution channels to shifting customer needs, banks will continue to rely on digital innovations to drive their transformation in the coming years.

Digital tools that leverage agile modelling, forecasting and scenario analysis functionalities will help banks monitor this multi-year journey which they must continue to refine according to market conditions.

Many of the challenges banks face today can be addressed by using cloud-based connected planning that allows organizations to run virtually any planning process by connecting data, people and plans across every part of a business. Scenario modelling and forecasting will be great assets to support a forward-looking approach towards agile transformation efforts.