The artificial intelligence (AI) software market has experienced tremendous growth over the past several years. Many enterprises have discovered that AI software can help cut costs and generate new revenue streams.

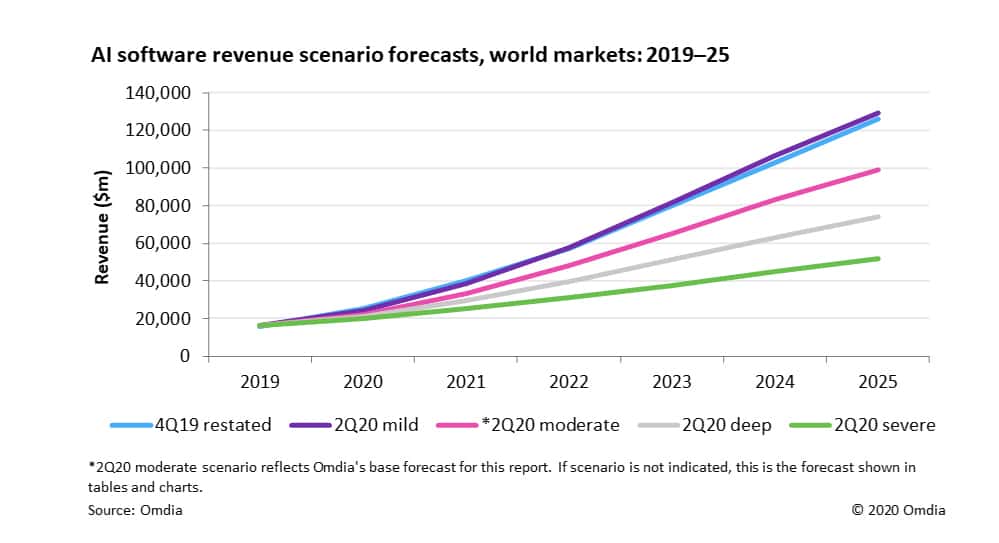

The worldwide market for AI software will expand to $98.8 billion by 2025, rising by a factor of six from $16.4 billion in 2019—despite the varying effects of the COVID-19 pandemic across different industries.

That said, AI software remains a relatively small portion of overall software sales, with varying acceptance across industries. The AI software market has entered a new phase in which AI is a requirement for most enterprises to compete on a global level.

Significant opportunity lies ahead for AI software market penetration despite short-term economic and market turbulence from the COVID-19 pandemic.

AI software employs several different technologies that give computers human-like abilities of perception, reasoning, planning, and decision-making. Most AI systems today are machine and deep learning (ML and DL) systems; other technologies include natural language processing (NLP), computer vision (CV), machine reasoning (MR), and strong AI.

Omdia has built a taxonomy of 340 AI use cases across 23 industries that captures the software opportunity related to AI. A new breakout aggregates the 340 use cases to 14 horizontal markets. Under the moderate impact scenario, global AI software revenue is expected to grow at a 34.9% CAGR to reach nearly $100bn in 2025.

Factors impacting AI adoption

While the COVID-19 pandemic has dampened growth forecasts for the market, its impact is uneven across industry sectors. While some industries are retrenching—such as energy, oil, gas, & mining—a few markets, like healthcare, are accelerating AI adoption.

Recognising the unpredictability of COVID-19, Omdia has developed four market scenarios based on the duration of the pandemic and the severity of its economic effect.

Omdia’s moderate scenario presented in this press release foresees continued double-digit growth ahead, although the cumulative market size for 2019-2025 will be reduced by 22% compared to the pre-COVID forecasts.

Omdia senior analyst, Neil Dunay says economic effects from the COVID-19 pandemic have widened the dichotomy between early AI adopters—the ‘AI haves’—and the trailing followers—the ‘AI have nots’.

“Industries that have pioneered AI deployments and have the largest AI investments are likely to continue to invest in what they view as proven, indispensable technology for cost-cutting, revenue generation, and enhancing customer experience,” he concluded.