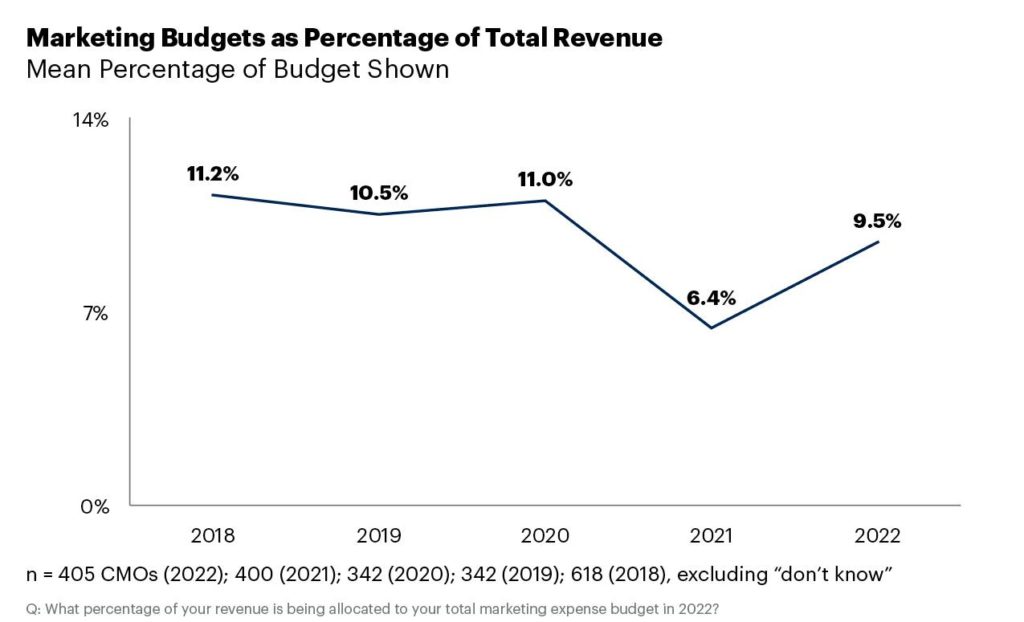

Gartner says marketing budgets have climbed to 9.5% of total company revenue in 2022, an increase from 6.4% in 2021. While marketing budgets are increasing this year, they still lag pre-pandemic spending levels.

“In the face of telling macroeconomic considerations, CMOs hold on to a belief that their own economic outlook is strong,” said Ewan McIntyre, chief of research and vice president analyst in the Gartner for Marketing Leaders practice. “Despite inflation, the Russian invasion of Ukraine, supply chain issues exacerbated by China’s lockdown measures and unprecedented talent competition, CMOs appear sanguine. For example, the majority of CMOs surveyed thought inflationary pressures hitting their business and their customers will have a positive impact on their strategy and investment in the year ahead.”

Seventy per cent of respondents reported their budgets had increased this year, however with marketing budgets increasing to 9.5% of total company revenue, it is still down from the average budget between 2018 and 2020 of 10.9% (see Figure 1).

Source: Gartner (May 2022)

Offline channels are rebounding

CMOs have made the shift from digital-first to hybrid multichannel strategies. When asked to report the proportion of their 2022 budget allocated to online and offline channels, online channels take the largest share (56%).

Offline channels account for almost half the total available budget (44%) - a more equitable split than in recent years. Looking at the average spend across industries, social advertising tops the list, closely followed by paid search and digital display.

“There has been a lot of discussions around COVID-19 shifting consumers to a digital-first mindset. However, as Western Europe and North America relax pandemic protocols, customer journeys have recalibrated,” said McIntyre.

He added that post-lockdown, CMOs need to listen carefully to their customers and pay attention to the channels they are using, as this more closely resembles a hybrid reality.

Marketing spend is on the rise

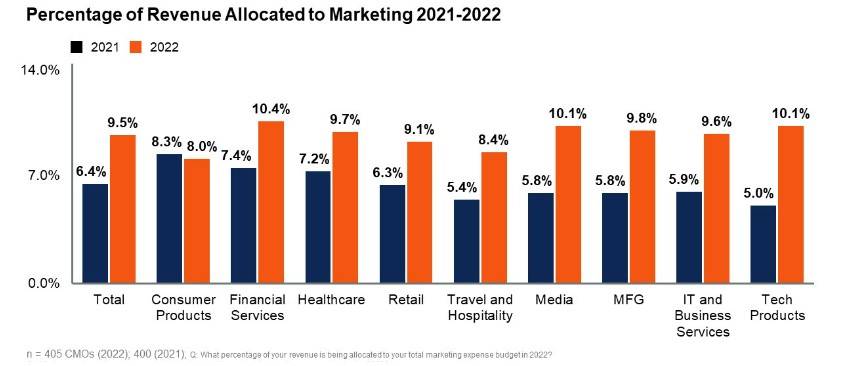

Average marketing spending has increased across almost all of the industries surveyed, with some significant variances (see Figure 2). Financial services companies recorded the highest budget, at 10.4% of company revenue, up from 7.4% in 2021. While eight out of the nine industries surveyed reported budget increases, spending for CMOs in consumer goods firms has stagnated, moving from 8.3% in 2021 to 8% in 2022.

Source: Gartner (May 2022)

Confidence handicapped by resource constraint

The brand was one of the lowest-ranked capability gaps in the survey, showing that CMOs are confident in their capabilities to manage brands. When asked to report their budget allocations across marketing's programs and operational areas, brand strategy and activation are near the top of the list, accounting for nearly 10% of the budget.

However, other strategic capabilities gap still persist: Marketing data and analytics was identified by 26% of CMOs as a top capability gap, followed by customer understanding and experience management (23%), and marketing technology (22%).

These specific instances illustrate a larger resource challenge for CMOs, with the majority (58%) of CMOs reporting that their teams lack the capabilities required to deliver their strategy.

McIntyre says marketing is experiencing a historic surge in talent demand in 2022. “Prioritizing the proper mix of resources should be a mission-critical priority for CMOs in order to attract and retain the capabilities they need to deliver against their CEO’s goals, such as focusing on brand and customers,” he continued.