While the COVID-19 pandemic hit China hard – it hit the world even harder. The World Economic Forum suggested that “companies that have not already done so should prioritize analysing their supply chains now, to understand where they might need to make changes or take action to mitigate against future disruptions.”

A Gartner survey revealed that 87% of supply chain professionals plan to invest in resilience within the next 2 years. Is that 2 years down the road 2 years too late?

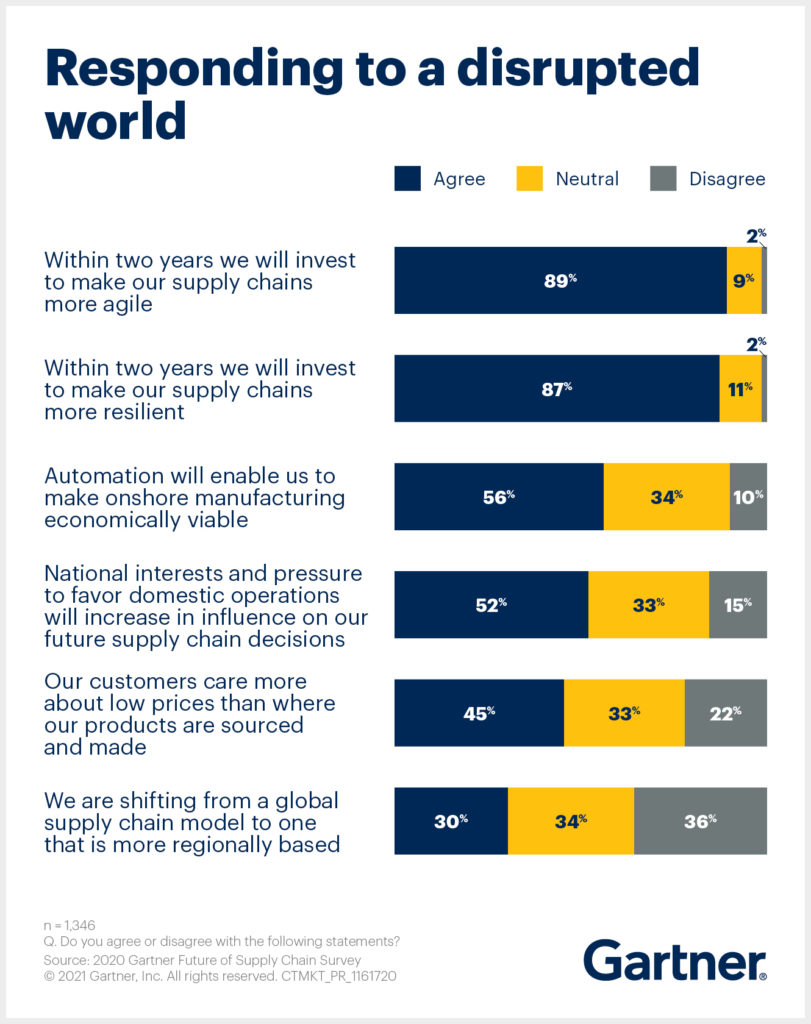

A Gartner survey of more than 1,300 supply chain professionals globally found that 87% of respondents plan investments in supply chain resiliency within the next two years. The survey identified agility (89%) as high on the interest of these professionals. (see Figure 1).

However, cost remains a priority, challenging chief supply chain officers (CSCOs) to find a new balance between resiliency, cost-efficiency and fulfilling increasing customer demands.

“Supply chain executives overwhelmingly recognize the necessity to make their networks more resilient and agile,” said Geraint John, vice president analyst with the Gartner Supply Chain practice.

“At the same time, 60% admit that their supply chains have not been designed for resilience, but cost-efficiency. The challenge will be to create an operating model for supply chains that combines the best of both worlds and also delivers supreme customer service.”

Gartner defines resilience as the ability to adapt to structural changes by modifying supply chain strategies, products and technologies, and agility as the ability to sense and respond to unanticipated changes in demand or supply quickly and reliably, without sacrificing cost or quality.

Figure 1: Responding to a Disrupted World

Source: Gartner (February 2021)

Three-quarters of respondents believe that the additional costs caused by the investments in resilience and agility will be covered by the supply chain budget. That’s why CSCOs must take the lead in identifying where and how much to invest.

“In practice, the concrete investments will likely be a series of activities ranging from incremental projects in small firms to transformative capital investments by global industry leaders,” John added. “We see that many organizations are investing in diversifying their supply base and redesigning products to mitigate risk. More collaborative relationships with key customers and suppliers is also a priority for almost all respondents.”

National interests clash with competitive pricing demands

Especially high tech, healthcare and pharmaceutical organizations report that national interests will have increased influence over future supply chain decisions. This does not only refer to imminent national needs, such as vaccines and personal protective equipment, but is also a result of ongoing issues, such as the U.S.-China trade war or Brexit.

At the same time, 45% of survey respondents think that their customers favor low pricing over domestic sourcing and production – particularly in industries with ferocious price competition, such as retail and fashion. Cost differentials and cost-efficiency will remain key considerations for these supply chains – as for others – when evaluating any redesign of their operational networks. Almost half of survey respondents see lean methodologies, just-in-time systems and low-cost country sourcing as relevant to future strategies.

Only 30% of survey respondents report that they are shifting from a global to a more regionalized supply chain model. The high level of integration in global supply chains, the regulatory burden of moving already established supply chains to a different location and the concentration of key suppliers in certain geographies make it difficult to completely regionalize a supply chain network. Further, high labor costs and a shortage of skilled manufacturing workers have long been an argument against domestic production in developed Western economies.

Automation as the key to domestic manufacturing

Advanced robotics and other automation technologies provide opportunities to overcome this constraint. Fifty-six percent of survey respondents think that automation will enable them to make onshore manufacturing economically viable.

“Ultimately, the right balance between investments in resilience and agility, and cost-optimization depends on each organization’s individual circumstances, including their financial strength, market position, appetite for risk and external factors such as regulatory requirements or supply chain constraints. If CSCOs choose their investments wisely, they can expect to see positive results as soon as the next disruption,” John concluded.