Over the past two months, I’ve had the privilege of joining briefing calls with 20 different supply chain organisations as part of the Supply Chain Top 25 analyst education process. Having run this research program for several years, I’ve found no better way to quickly dip into the latest and greatest challenges, innovations and trends of the most advanced supply chains in the world.

What are the common threads running through these companies’ updates? For the sake of space, I will focus on the white-hot topic of artificial intelligence.

The Lay of the (AI) Land

Companies choosing to educate the Gartner expert team as part of the Supply Chain Top 25 program are asked to share details on their technology investments and key initiatives past, present and future. This information is less delineated by specific program lifecycle stage, so I’ll share the results of a recent AI survey fielded with our global COO and CSCO community. Many of these companies occupy high positions on our Global Top 25 list.

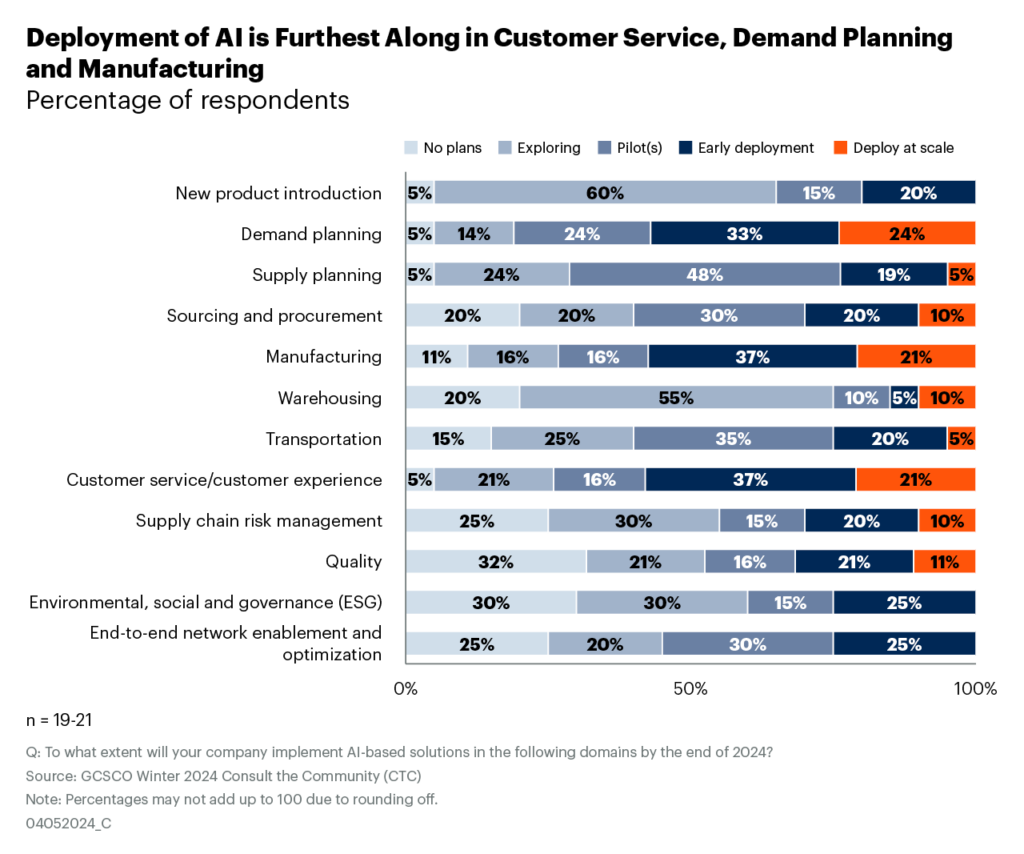

The survey asked respondents to state where they expect their AI solutions to be in the development and deployment lifecycle by the end of 2024. It spanned functional (plan, source, make, etc.) and end-to-end domains, such as supply chain risk management and ESG.

The most popular areas where these leaders expect to be in full deployment by end of year either face customers (demand planning and customer service/experience at 24% and 21%, respectively) or live within the four walls of manufacturing sites (21%).

On the other end of the spectrum, nearly a third of respondents have no plans to leverage AI for either quality management or ESG-related applications. When comes to GenAI, the most common 2024 plan for this group is conducting pilots, but nearly 40% will shift into deployment mode for promising applications.

Another important signal that emerged from this survey is the need for clear communication on how AI adoption will impact employees’ roles. For example, only a quarter of companies surveyed plan to reduce headcount over the next few years, in conjunction with newly deployed AI capabilities, but 95% believe their employees fear a significant employment impact from AI. Unfortunately, in the absence of information, many people will expect the worst outcome.

Leap in performance

My general observation from this year’s Top 25 company briefings is that the degree to which supply chains are leaning into pilots and broader investments in AI and GenAI is a performance differentiator — propelling the “haves” further ahead of the “have nots.”

To be clear, it is early days, particularly for GenAI, and a lot of experimentation will be required to sort the winning applications from the hype. But as lottery aficionados are fond of saying, “you’ve got to play to win.”

Here are anecdotes shared by some of the more mature supply chain organisations making these investments:

Several Top 25 leaders stated that automation in frontline environments, such as warehouses and factories, and the use of logical automation through traditional and GenAI is starting to hit the accelerating portion of the performance S-Curve.

A life sciences company loaded supply, demand and inventory data into an LLM-type model. Using natural language, planners can interrogate the model on the root causes of supply-demand mismatches and identify the largest opportunities to decrease inventory levels without impacting service. The initiative has freed up tens of millions of dollars in cash.

A consumer products company used an AI-based analysis to reduce its SKUs by 20%, improving margins with no impact to sales.

A high-tech company created a causal AI demand-sensing tool and found unanticipated relationships between country-level demand for its products and government macroeconomic statistics, such as bond yields and investment patterns.

Another tech company is using GenAI for intelligent fulfillment status and issue resolution. Its natural-language-based bot can provide insights on order status and the root causes behind unanticipated delays. The bot’s analysis and response take 10 minutes versus the roughly two-and-a-half days required by hunting-and-pecking humans.

Originally posted in Gartner.