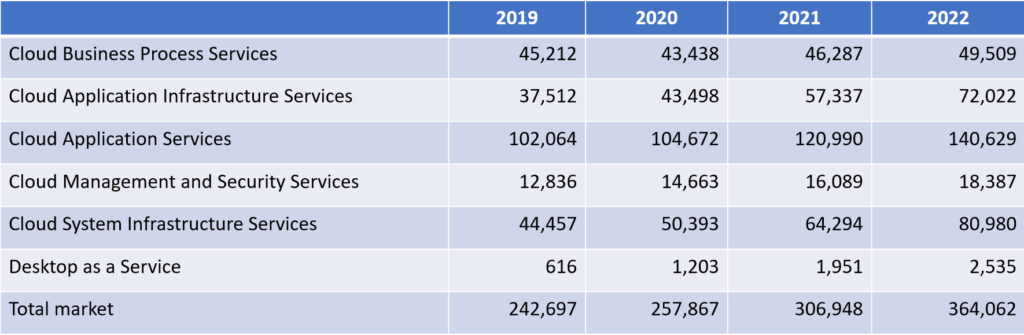

Gartner says the worldwide public cloud services market is forecast to grow 6.3% in 2020 to total $257.9 billion, up from $242.7 billion in 2019.

Desktop as a service (DaaS) is expected to have the most significant growth in 2020, increasing 95.4% to $1.2 billion. DaaS offers an inexpensive option for enterprises that are supporting the surge of remote workers and their need to securely access enterprise applications from multiple devices and locations.

“When the COVID-19 pandemic hit, there were a few initial hiccups but cloud ultimately delivered exactly what it was supposed to. It responded to increased demand and catered to customers’ preference of elastic, pay-as-you-go consumption models,” said Sid Nag, research vice president at Gartner.

Software as a service (SaaS) remains the largest market segment and is forecast to grow to $104.7 billion in 2020 (see Table 1). The continued shift from on-premises license software to subscription-based SaaS models, in conjunction with the increased need for new software collaboration tools during COVID-19, is driving SaaS growth.

The second-largest market segment is cloud system infrastructure services, or infrastructure as a service (IaaS), which is forecast to grow 13.4% to $50.4 billion in 2020. The effects of the global economic downturn are intensifying organizations’ urgency to move off of legacy infrastructure operating models.

Table 1. Worldwide Public Cloud Service Revenue Forecast (Millions of U.S. Dollars)

BPaaS = business process as a service; IaaS = infrastructure as a service; PaaS = platform as a service; SaaS = software as a service

Note: Totals may not add up due to rounding.

Source: Gartner (July 2020)

Public cloud services serve as the one bright spot in the outlook for IT spending in 2020. Cloud spending in many regions is expected to grow rapidly as economies reopen and more normal economic activity resumes, with regions such as North America expecting to return to higher spending levels as early as 2022.

Nag said the use of public cloud services offer CIOs two distinct advantages during the COVID-19 pandemic: cost scale with use and deferred spending. CIOs can invest significantly less cash upfront by utilizing cloud technology rather than scaling up on-premises data centre capacity or acquiring traditional licensed software.

“For the remainder of 2020, organizations that expand remote work functionality will prioritize collaboration software, mobile device management, distance learning educational solutions and security, as well as the infrastructure to scale to support increased capacity,” said Nag.