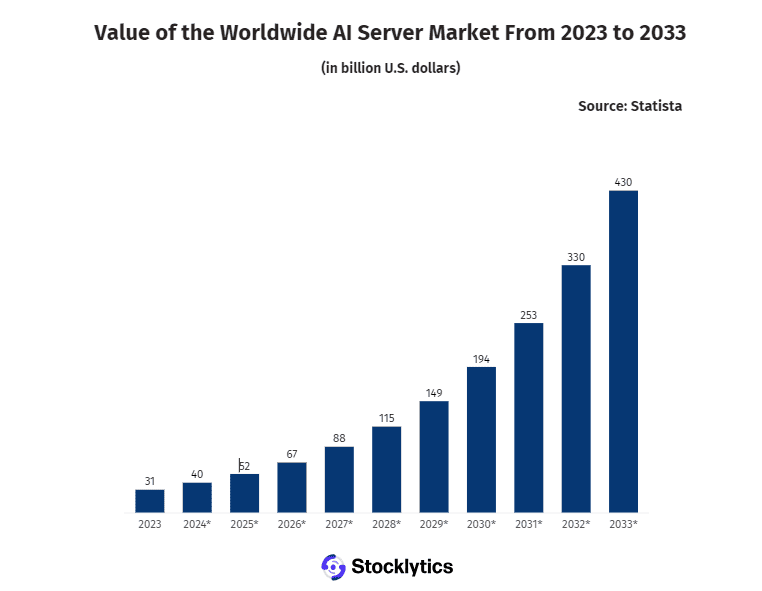

Stocklytics.com reports AI server spending to hit $430 billion by 2033 from only $40 billion in 2024.

“The rise in AI server spending highlights the budding demand for AI capabilities and the significant shift in how businesses and governments approach data processing and machine learning,” said Edith Reads, financial analyst at Stocklytics.

AI server spending

Projections reveal that AI server spending will increase by over $9 billion from 2023 to $40 billion by the end of 2024. According to forecasts, companies are expected to spend over $50 billion in 2025 and almost $70 billion in 2026, with a projected server spending of $67 billion, promising significant profits in the server market.

Analysts project a robust and steady growth in the revenue of the AI server market, reaching $88 billion in 2027 and a staggering $430 billion by 2033, shooting up by over 30% from 2032 and over 975% from 2024.

Rising demand

Due to heightened server demands, Super Micro Computer, Inc. (SMCI) is planning to add warehouses and upgrade its rack-scale production. Stocklytics also reports that Foxconn is strategising to make AI servers its next “trillion Taiwanese-dollar revenue product,” while Dell has been selling its servers at near-zero margins.

“Besides, Nvidia’s next-generation GPU manufacturing has called for ramped-up production for more advanced servers that can accommodate them. NVIDIA’s next-generation Blackwell, including GB200 and B100/B200, can run massive AI models at 25 times lower costs than previous Nvidia hardware and are expected to drive server demand all through 2025. Google has already ordered more than 400,000 Blackwell chips despite continuous developments in its custom hardware, Tensor Processing Units (TPUs),” Sotcklytics author Edith Muthoni wrote.